A-Team Insight Knowledge Hub RTI The latest content from across the platform

Why Further Brexit Delay Creates Greater Reporting Uncertainty for Fund Managers

By Quinn Perrott, co-CEO of TRAction. There is a funny sense of déjà vu when it comes to the latest twist in the Brexit saga. The trouble is that whenever the can gets kicked down the road, market participants put Brexit to one side and allocate IT, process management and compliance resources elsewhere. Then, as…

Fenergo Launches Digital KYC

Fenergo today announced the launch of a new product enhancement, Digital KYC, a real-time, rules-driven, API-enabled KYC solution enabling financial institutions to automate and perpetuate KYC compliance reviews. The product works with existing client lifecycle management (CLM) solutions, automating continuous customer due diligence (CDD) reviews for low to medium-risk clients and reducing the need for…

Legal Compliance Planning Q&A: What Should Your Top AML Priorities Be for 2020?

Every bank needs a law firm, and the legal department is often the silent partner in the compliance dialogue – but their expertise is nonetheless essential. With 2020 on the horizon and regulations such as the EU’s Fifth Money Laundering Directive (5MLD) front and centre when it comes to compliance, many law firms will be…

EBA to Prioritise AML in 2020 Work Programme, ESMA to Focus on EMIR 2.2

The European Banking Authority (EBA) has released its Work Programme for 2020, with a focus on prioritising anti-money laundering (AML) regulations, moving towards an integrated EU data hub, and delivering the new ‘Basel IV’ banking package. The authority plans to work “intensively” on the mandates from the Risk Reduction Measures (RRM) package with a view…

TISA’s MiFID II Technical Solution Gathers Pace, Vendor to be Confirmed by November

TISA, the investing and saving membership alliance, has reported a high-quality response from suppliers to its Request for Information phase towards developing an industry-sponsored technical solution for MiFID II reporting. Part of TISA’s MiFID II Costs & Charges and Target Market reporting project, which is setting standards and developing a governance framework, the technical solution…

Moody’s Analytics Upgrades RiskAuthority Solution to Help Banks Address Final Basel III Rules

Financial intelligence provider Moody’s Analytics has added extra functionality to its RiskAuthority solution to help banks prepare for the final Basel III regulatory framework. The new features are designed to address a number of changes in the final Basel rules, including calculations for Credit Risk, the standardized approach for measuring Counterparty Credit Risk (SA-CCR), and…

Standard Charted Bank Launches Bearing Point Tax Solution

BearingPoint RegTech has confirmed that Standard Chartered Bank has successfully deployed the tax reporting solution FiTAX to fulfill its global reporting obligations. These include CRS (Common Reporting Standard), FATCA (Foreign Account Tax Compliance Act) and QI (Qualified Intermediaries) reporting.

SmartSearch Receives Growth Equity Investment from Marlin Equity Partners

AML specialist SmartSearch has received a growth equity investment from Marlin Equity Partners, an investment firm with a long track record of backing software innovation. SmartSearch enables organisations to carry out AML checks without requiring clients to provide identity documents, with individual AML checks taking less than 30 seconds and business checks taking less than…

ACA Compliance Opens New Office in Birmingham

GRC tech specialist ACA Compliance has expanded its European presence with an office in Birmingham, UK. Key to the services offered from the new location will be ACA’s Analysis and Review Centre (ARC). The ARC helps to reduce the workload of Chief Compliance Officers (CCOs) and in-house compliance teams by allowing them to pass on…

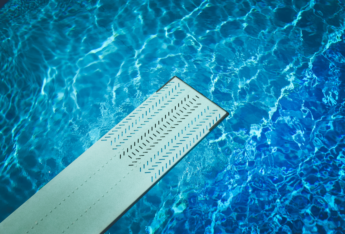

A Dive Into the Detail of Sourcing and Managing Data for FRTB

There is no silver bullet for compliance with the Fundamental Review of the Trading Book (FRTB). The data sourcing and management requirements of the regulation are among the most difficult that capital markets participants have ever faced, the cost of implementation can be crippling, and the January 2022 compliance deadline has been finalised. So, how…