A recent report from regulatory compliance platform provider Cappitech offers a window on how firms are complying with best execution requirements under Markets in Financial Instruments Directive II (MiFID II) by slicing and dicing the MiFID II RTS 28 data that EU-based financial services firms were required to submit to EU regulators in April of this year.

Dealing with data quality

Firms have been struggling to meet MiFID II regulatory reporting requirements due to a combination of challenging legacy trading systems and a lack of data governance. Last year, firms were able to report RTS 28 information on a best effort basis. However, this year, the reporting requirements are firm, and significant enforcement activity focused on data quality is expected to start later this year and continue into 2020.

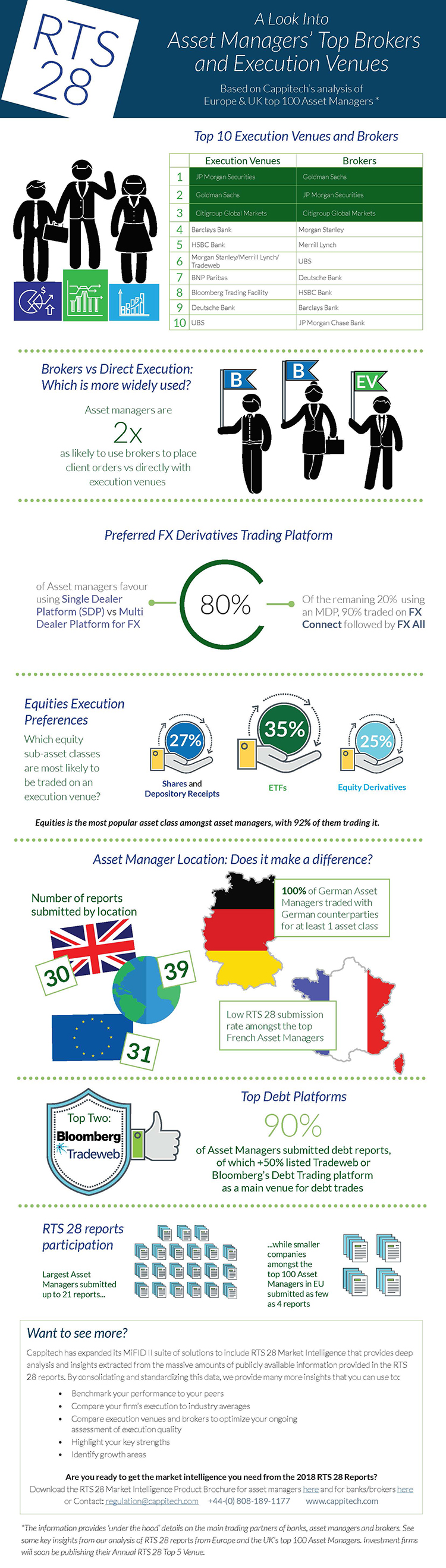

MiFID II RTS 28 requires firms to report their top five execution counterparties across all of the asset classes in which they are active. They must do this for both retail and professional orders, and also provide a summary of the execution quality that they achieved. In a related rule, they must also disclose the top five broker-dealers that trade on their behalf.

While this seems like a relatively straight-forward dataset to report, for some firms it requires bringing together hundreds of individual datasets – geographically, by business silo, and by technology platform. Banks are still facing significant challenges with BCBS 239 reporting, which requires a similar kind of harnessing of internal data. For RTS 28, both buy-side and sell-side firms must submit data.

According to the Cappitech analysis, submission levels varied considerably by geography – the UK turned in 30 reports, while globally, 39 reports were submitted. Across the EU, 31 reports were sent in. However, there was a low RTS 28 submission rate among the top French asset managers. The number of reports submitted by firms also varied widely, with the largest firms turning over up to 21 reports on individual asset classes, while small firms (considered to be among the top 100 asset managers in the world) submitted as few as four reports.

Insights into the markets

Despite these variances, the reports did reveal some interesting facts about the impact that MiFID II is having on trading. Overall, it appears that a larger proportion of buy-side flow is going to buy-side firms’ top five brokers. During 2017, 71.8% of the flow of the top 100 European buy-side firms was directed towards firms’ top five brokers. In 2018, the figures were 82.7% (small cap instruments), 75.2% (mid-cap instruments) and 79.8% (large cap instruments). This could mean the big brokers are simply getting bigger as a result of MiFID II.

Also, internalisation of trades seems to be falling as a proportion of all trades. In the sample in the Cappitech report, internal entities were used to execute 26.1% of order flow on average in 2017. In the 2018 report, systematic internalisers (SIs) executed 20.4% (small cap), 13.9% (mid-cap) and 18% (large cap) of order flow. Specific firms significantly decreased their levels of SI usage – for example, Bank of America Merrill Lynch internalised 31% of its activity in 2017, but in 2018 used its SI for just 4.1% of activity on average across all equity instrument sizes. Similarly, Morgan Stanley internalised 27% of its activity during 2017, but used its SI for just 9.7% in 2018.

Subscribe to our newsletter