Data Management Insight Blogs The latest content from across the platform

Hexaware QnA: Combining Human Skills and AI to Solve Data Challenges

London-based Hexaware is an artificial intelligence-led software designer that has been solving the data challenges for financial institutions and other regulated industries for more than 30 years. Data Management Insight spoke to director of operations Param Iyer about the pain points Hexaware seeks to solve. Date Management Insight: Hello Param. When was Hexaware created and how does it serve…

Record Debt Issuance Is Exposing The Bond Market’s Information Gap

By Swati Bhatia, head of fixed income, financial information at SIX. Sovereign bond issuance across the OECD’s member countries is predicted to have reach a record US$17 trillion at the end of last year, a scale of borrowing that would have seemed mind-boggling only a few years ago. On the corporate debt side, the total…

Alkymi’s AI-led Private Credit Seeks to Bring Transparency to Growing Market

Credit has become a key growth pole for private investors as loans and similar instruments have benefited from rising rates and wider public credit spreads. Interest in the sector is so strong that Morgan Stanley forecasts its value will rise to $5tn by 2029 from $3tn this year. The difficulty for institutional investors clamouring to…

GoldenSource CEO Corrigan Lays Out Three-Year Plan of Change and Innovation

Eighteen months into his stewardship of GoldenSource, chief executive James Corrigan says the company is entering its next phase with a clear, practical three-year plan. Corrigan describes a disciplined approach: decide where the firm will compete, be explicit about what sets it apart, and align the organisation behind a short list of priorities. “If you don’t evolve your business model,…

Personal Investment Pain Point Sparks Idea for Fast-Growing Wealth Tech Firm Goodfin

Anna Joo Fee had a problem. The Wall Street lawyer was so busy in her job that managing her wealth adequately was difficult. Her options were limited, however. Institutions wanted the capital that high earners could offer, but were not best placed to serve the market. And she wasn’t confident in her own knowledge to…

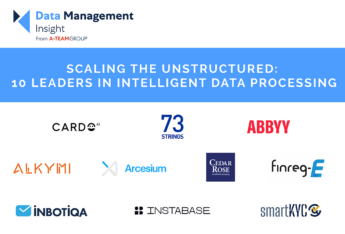

Scaling the Unstructured: 10 Leaders in Intelligent Data Processing

Huge swaths of critical financial information, from private credit agreements and ESG disclosures to complex tax documentation, is locked in unstructured formats such as digital documents and PDFs. The manual bottleneck this creates for the middle and back office eats into valuable resources. A key means to achieving this, Intelligent Data Processing (IDP), represent a…

Introducing Market & Alt Data Insight: Advancing the Industrialisation of Data in Financial Markets

Financial markets are entering a new phase in the evolution of data. Data has always underpinned trading and investment workflows. What has changed is the scale, diversity and strategic management of that data across the enterprise. Traditional market data, alternative signals, derived datasets and AI-generated features now sit on the same operational continuum. The strategic…

The Quest for Better Data Management Through Trusted Data Products

Quest Software has built its reputation on protecting digital identities, assisting companies’ data migrations within the Microsoft ecosystem. But the Austin, Texas-based firm also has a data management business that has been addressing both the database and metadata management ecosystems. As artificial intelligence begins to take a dominant role in data management and among financial…

Beyond the Pilot: Building Infrastructure for the Agentic Era

By David Sewell, Chief Technology Officer, Synechron. The fraud transaction takes milliseconds to clear. In that window, an agentic system has already queried three databases, cross-referenced two watchlists, and pinged the identity verification layer. It works – in the demo. Then the auditor asks where the decision log is, and nobody can find it, because…

NeoXam Sets Sights on Narrowing Private Data Gap Between GPs and LPs

As demand for private markets data accelerates, asset allocators are finding themselves having to play digital catch up with their investor counterparts. General partners (GPs), who manage private funds and allocate capital invested by limited partners (LPs) have found themselves technologically behind the curve as institutional investors plough into the once-niche markets. But because LPs are…