TradingTech Insight Market Data & Analytics The latest content from across the platform

Pico Launches Test Lab to Enable Replication of Real-World Trading Environments

Pico, the technology services, software, data and analytics vendor, has launched the Pico Performance Lab, offering high-performance testing resources to financial services firms. The Lab provides customers with the ability to implement, simulate and test Pico’s full-stack trading technology solution, including infrastructure, connectivity, market data, trading software, critical timing services and Corvil Analytics. The Lab…

OptionsDesk Adopts ION’s XTP Front-to-Back Suite for Exchange-Traded Derivatives

OptionsDesk, the UK options broker that provides advisory and brokerage services for retail investors, corporations, and financial institutions, has signed a long-term strategic partnership with ION, the trading, analytics, treasury and risk management solutions vendor. The deal will enable OptionsDesk to expand its exchange-traded derivatives (ETDs) capabilities by utilising ION’s XTP Front-to-Back Suite for both…

Pico Upgrades Corvil VoIP Analytics

Pico, the technology services, software, data and analytics vendor, has announced a major upgrade to Corvil VoIP Analytics, its solution for providing real-time visibility of VoIP performance. The upgrade provides the ability to capture and decode lossless granularly timestamped data at 100GB and apply it to VoIP applications. Future enhancements announced for release in 2023…

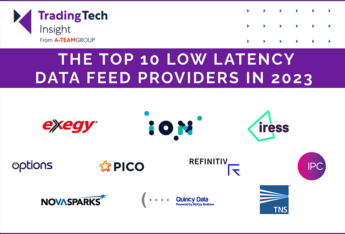

The Top Low Latency Data Feed Providers

Low latency data feeds have become a crucial component of today’s electronic financial markets. Not just for high-frequency trading firms, but across the industry. Buy side and sell side firms rely on fast, accurate market data to make informed decisions in real-time for a wide variety of use cases – from improving trading performance to…

S3 Partners Launches Black Map, Providing Visibility into Herd Risk and Market Sentiment

S3 Partners, the financial data marketplace and workflow platform, has launched S3 Black Map, the latest evolution of S3’s platform, giving users visibility into long and short market sentiment, exposure to concentration and herd risk, and positioning of passive and active investment strategies in the marketplace. Users can filter by industry, sector and cohort to…

Iress Partners with Megaport to Provide Global Cloud Connectivity for Market Data

Iress, the financial software, services and technology company, has entered into a strategic partnership with Megaport, a global Network-as-a-Service (NaaS) provider, to provide additional connectivity between Iress and all major public cloud service providers (CSPs), including AWS, Microsoft Azure and Google Cloud Platform. The partnership will enable Iress clients to directly access global markets from…

BMLL Hires Industry Veteran Rob Laible as Head of Americas

Following its recent US$26 million funding round, BMLL, the independent provider of harmonized, historical Level 3 data and analytics, has appointed industry veteran Rob Laible as Head of Americas, with plans to open a New York area-based office. Laible comes with over 30 years’ experience of running global institutional businesses across sales and trading, technology,…

Pico Appoints Bo Zhou as Head of APAC

Pico, the technology services, software, data and analytics vendor, has named Bo Zhou, Ph.D., as Head of APAC to oversee Pico’s continued growth in the region. Zhou brings more than 15 years of financial markets industry experience and was most recently Partner and Senior Managing Director for IHS Markit (now S&P Global). Previously, she served…

TMX Group Acquires 21% of VettaFi for US$175 Million

Hot on the heels of its recent acquisition of Wall Street Horizon, TMX Group, the Toronto-based market operator and data and analytics provider, has acquired approximately 21% of the common equity of VettaFi Holdings LLC, a US-based, privately owned data, analytics, indexing and digital distribution company, for US$175 million. VettaFi provides a comprehensive suite of…

Cosaic Sells ChartIQ to S&P Global and Spins Off Finsemble

Cosaic, the data visualisation and smart desktop technology vendor, has sold its ChartIQ data visualisation business to S&P Global, the credit ratings, benchmarks and analytics provider. The acquisition, which closed on January 1, 2023, will form part of the S&P Global Market Intelligence division. ChartIQ’s data visualisation capabilities will now be added to the S&P…