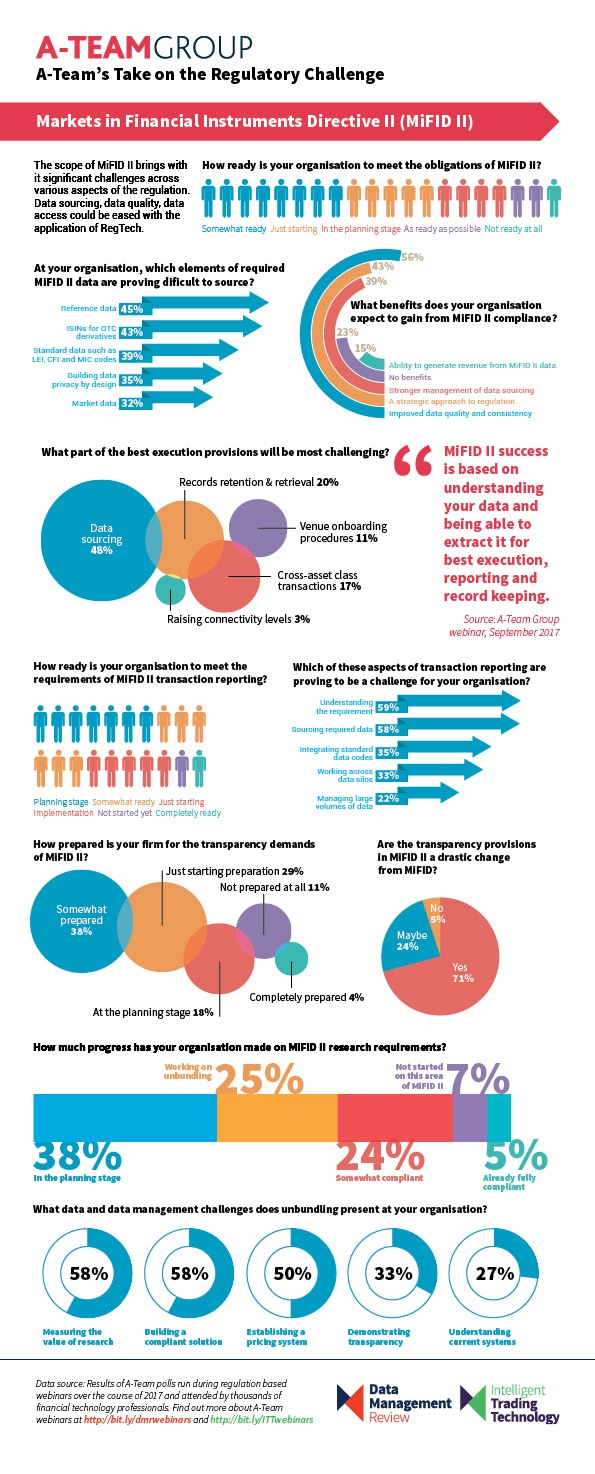

Markets in Financial Instruments Directive II (MiFID II) is a game changer for European capital markets and a headache for trading operations and data management functions developing compliance solutions for its exacting requirements.

At A-Team Group, we’ve been tracking industry progress on the regulation and with less than three months to go before the compliance deadline of January 3, 2018, we’ve pulled together data from audience polls run during our 2017 MiFID II webinars to illustrate ongoing pain points – and potential benefits – of implementing the regulation. To learn more about how your peers in financial technology are managing the challenges of implementing MiFID II, register to join our upcoming live webinars, or listen to our webinar recordings at any time.

Click on the infographic for a larger version.

Subscribe to our newsletter