This week’s report from the FSB warning of the perils of cloud deployment for financial institutions doubtless will give cause for serious consideration of whether and how to shift certain activities to commercial public cloud platforms. But the fact remains that practitioners will continue in their quest to push what they can off-premises and onto public and private cloud environments.

While much of this effort so far has focused on using commercial cloud platforms as a way to add flexibility and agility to processes requiring sporadic access to large data sets, recent initiatives have seen trading-related activities drawing upon cloud capabilities.

In one recent example, a major investment bank deployed Ticksmith’s high-performance database management platform in its Amazon Web Services (AWS) cloud instance to analyse Vela’s SuperFeed to meet its transaction cost analysis (TCA) and best execution requirements.

Judging from the energetic discussions at our TradingTech Summit events this year, many practitioners are keen to explore how to move more trading-related processes to the cloud. Two developments in recent weeks involving market data in the cloud may help expedite things.

First came the announcement by AWS of the addition of IP multicast capabilities to its AWS Transit Gateway. This will support routing of multicast traffic between attached Amazon VPC connections, making it straightforward for AWS clients to build multicast applications in the cloud, and monitor, manage and scale multicast configurations.

Multicast allows delivery of a single stream of data to many users simultaneously, and this development could be used to support cloud delivery of subscription-based real-time market data services to authorised users. Until now, this has required significant workarounds to run these kinds of workloads in the cloud. The move is expected to spur new development of real-time market data solutions in the AWS cloud environment.

The second, related development is German market data integrator BCC Group’s initiative to enable migration into the cloud of applications supported by Refinitiv’s TREP (Thomson Reuters Enterprise Platform) market data distribution system.

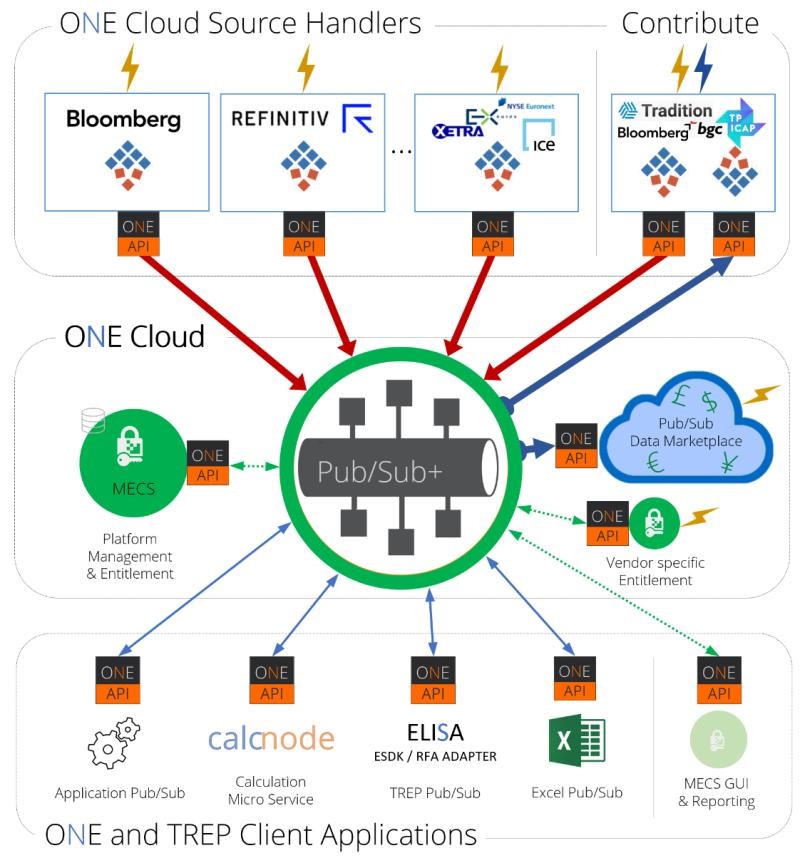

According to a recent BCC Group blog post, the company’s Elisa connector now allows integration of TREP-connected applications with BCC Group’s ONE cloud-enabled middleware platform. This means that TREP clients can make the Elektron SDK (software developers kit) and RFA (Reuters Foundation Architecture) applications cloud-ready, allowing them to migrate them to commercial cloud environments while retaining TREP as the core market data element of their trading technology infrastructure. Clients would also be able to use BCC Group’s Multivendor Entitlement Control Service (MECS) entitlement system to manage access to these cloud-based services.

As one respondent to the blog post pointed out, “Only a thin wedge of TREP use cases could be served by an MDS [market data system] in the cloud. [T]he reality is for a front-office trading function, significant and often unexplained latency delays resulting from Cloud deployments will be difficult to explain to the business on a weekly basis.”

That said, co-existence with TREP addresses a significant hurdle to implementing mission-critical market data services in the cloud. According to the BCC Group blog post: “Elisa allows you to connect RFA and ESDK bound applications into the cloud. And because Elisa is a ONE Solution component that integrates data from Refinitiv, Bloomberg, Morningstar, ICE and many other sources in the cloud, your applications can now start consuming data in real-time from any provider simultaneously and of course without programming. Elisa understands all your TREP bound applications and even allows them to publish into the cloud. All Elisa data is entitled like all other data in the ONE Platform, be it published or subscribed. With the ONE Solution family of products you can even start selling your in house data over the cloud. Use your existing interactive providers and have Calcnode calculate and publish prices in real-time to the cloud.”

Subscribe to our newsletter