TradingTech Insight Data Delivery, Cloud & Managed Services The latest content from across the platform

Man Group Partners with Bloomberg to Develop New DataFrame Database Product

Man Group, the technology-empowered global investment firm, has signed a multi-year open-source technology development and product integration agreement with Bloomberg, the financial information company, to build upon Man’s DataFrame database product, ArcticDB, and to integrate it into BQuant Bloomberg’s open source analytics platform. ArcticDB is a high-performance Python-native database, built in response to the challenges…

A-Team Webinar to Discuss Data Transformation in Quant Research and Trading

Quantitative workflows rely on sourcing, aggregating, normalising and managing data. This can be highly resource-intensive, leading to a situation where some financial institutions with quant shops are more focused on data management than on data science and modeling. So how can the data ingestion, management, and pipeline processes of quant workflows be streamlined, allowing quants…

A-Team Group’s Lorna Van Zyl Featured on FinTech Focus TV, Discussing TradingTech Summit London

In anticipation of this year’s TradingTech Summit London, we’re delighted that A-Team Group’s Head of Event Content, Lorna Van Zyl, was the star guest on the latest episode of FinTech Focus TV, talking with Toby Babb of Harrington Starr. In a wide-ranging interview, Lorna shares what goes on behind the scenes when putting the event…

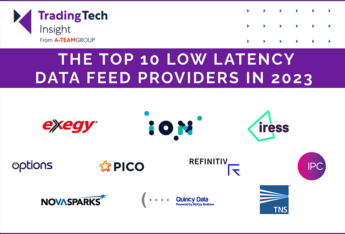

The Top Low Latency Data Feed Providers

Low latency data feeds have become a crucial component of today’s electronic financial markets. Not just for high-frequency trading firms, but across the industry. Buy side and sell side firms rely on fast, accurate market data to make informed decisions in real-time for a wide variety of use cases – from improving trading performance to…

Iress Partners with Megaport to Provide Global Cloud Connectivity for Market Data

Iress, the financial software, services and technology company, has entered into a strategic partnership with Megaport, a global Network-as-a-Service (NaaS) provider, to provide additional connectivity between Iress and all major public cloud service providers (CSPs), including AWS, Microsoft Azure and Google Cloud Platform. The partnership will enable Iress clients to directly access global markets from…

swXtch.io Integrates Timebeat’s Precision Time Protocol into cloudSwXtch

Following the recent launch of its cloudSwXtch high performance networking product for the cloud, swXtch.io, a wholly-owned subsidiary of IEX Group, has deployed and integrated Timebeat’s Precision Time Protocol (PTP) into the cloudSwXtch technology, enabling clock synchronization across hybrid cloud networks. The integration of the Timebeat PTP into cloudSwXtch adds standard PTP access to the…

Microsoft and LSEG Launch 10-Year Strategic Partnership as Microsoft Takes 4% Equity Stake in LSEG

Microsoft and London Stock Exchange Group (LSEG) have entered into a 10-year strategic partnership, under which LSEG’s data infrastructure will be architected using the Microsoft Cloud and the two companies will jointly develop new products and services for data and analytics. Microsoft has also agreed to purchase shares in LSEG that would result in Microsoft…

Recorded Webinar: Market data in the cloud

Over the past several years, the topic of market data in the cloud has been hotly debated – latency has been an issue, which data to put in the cloud has been discussed, and lines have been drawn. But where are we now, and how have the lines been redrawn? This webinar will consider progress…

Recorded Webinar: High-performance, real-time multi-stream data processing for trading analytics and risk management

Financial analytics platforms in Hedge Funds are often segmented between real-time and back-office analytics systems fed by slower batch processes. To support winning analytics, hedge funds and other trading firms need to bring together real-time streams with historical analytic data in a single high-performance data store to refresh reports and risk models in near-real-time. Listen…

Avelacom Launches One-Stop Access to Cboe Europe Derivatives (CEDX)

Avelacom, the low latency connectivity, IT infrastructure and data solutions provider, has launched a one-stop shop for low latency connectivity, IT infrastructure and market data solutions for pre-trade and execution on Cboe Europe Derivatives (CEDX), the pan-European equity derivatives marketplace. Avelacom’s point-of-presence (PoP) in Equinix LD4 is now directly connected to CEDX’s infrastructure. Avelacom’s PoP…