A Practical Framework for the AI-driven Trading Desk

By Vishal Gupta, Executive Director, Head of Equity Derivatives Technology, Mizuho Americas Services

By Vishal Gupta, Executive Director, Head of Equity Derivatives Technology, Mizuho Americas Services

The Tier 2 / Tier 3 Resilience Gap

Tier 2 and Tier 3 capital markets institutions face a growing resilience challenge in their Front-Office trading environments. Unlike Tier 1 banks, these firms operate with tighter technology budgets, smaller engineering and support teams, and heavier reliance on vendor platforms – yet they are exposed to the same market volatility, client expectations, and regulatory scrutiny.

Pricing engines, market data feeds, risk calculators, and execution gateways increasingly operate across hybrid architectures spanning on-premises systems, vendor platforms, and cloud services. At the same time, regulators are raising expectations around operational resilience, while AI is rapidly entering production trading workflows.

The result is a widening resilience gap. Not because mid-tier institutions lack intent or technical sophistication, but because their operating models were never designed to support today’s level of system interdependence, speed, and regulatory accountability. As complexity grows, traditional reactive support models struggle to keep pace – exposing firms to outages, degraded execution quality, and heightened operational risk.

Industry research from Splunk and Oxford Economics estimates that unplanned downtime costs Global 2000 companies more than $400 billion annually.

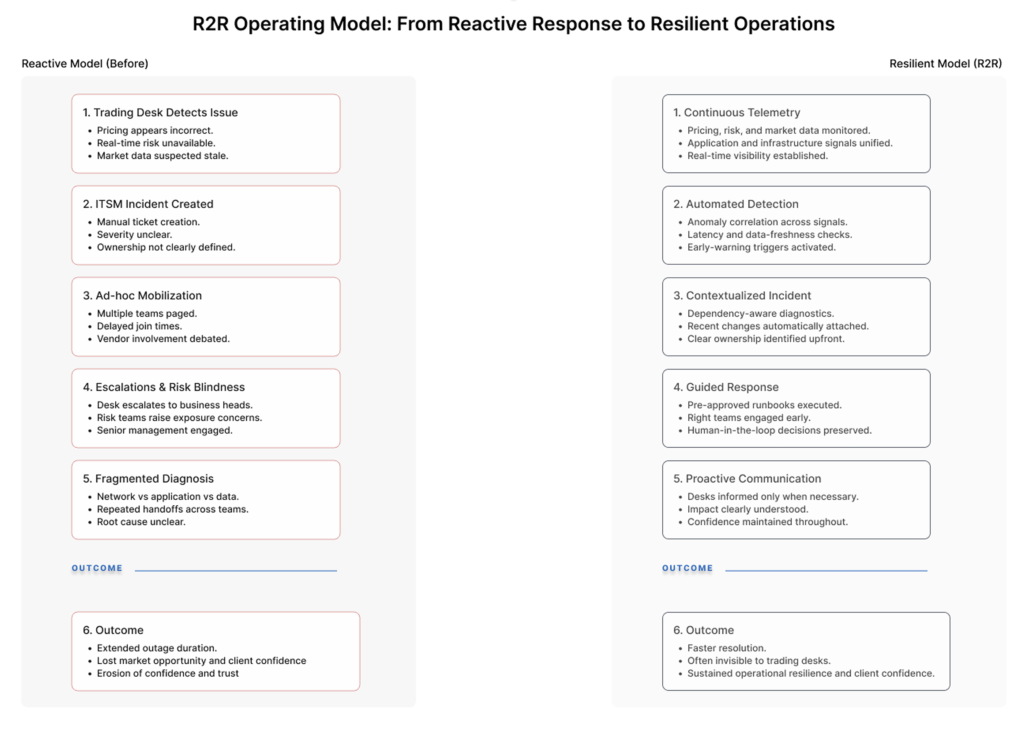

R2R (Reactive to Resilient) is an operating framework designed to close this gap. It provides a practical, scalable approach to Front-Office resilience that allows Tier 2 and Tier 3 institutions to achieve Tier-1-level operational outcomes without Tier-1-level budgets or organizational scale.

Why Resilience Breaks Down for Mid-Tier Firms

Front-Office systems were never designed to operate in today’s highly interconnected, multi-vendor trading environments. For Tier 2 and Tier 3 institutions, several structural realities consistently undermine resilience.

Siloed telemetry and fragmented visibility

Monitoring is distributed across infrastructure tools, vendor dashboards, application logs, and network systems acquired incrementally over time. Without a unified view, early warning signals – rising latency, queue buildup, partial degradation – often go undetected. Smaller teams lack the bandwidth to manually correlate signals across disparate platforms in real-time.

Figure 1. Illustrative example of fragmented telemetry across Front-Office systems

In practice, these gaps often surface during periods of market stress. In one composite scenario, a partial degradation in a third-party market data service silently propagated through pricing and pre-trade risk checks, delaying execution acknowledgements for over twenty minutes despite healthy exchange feeds – not due to missing tools, but due to fragmented ownership and dependency visibility.

Hidden dependency complexity

Trading workflows form tightly coupled chains: market data – pricing – risk – execution – booking. A delay or degradation in any upstream component cascades rapidly across the chain. Mid-tier institutions often have limited visibility into these dependencies, particularly when critical components reside inside vendor platforms.

Manual diagnostics and vendor opacity

Incident response frequently relies on human triage across multiple tools and teams, often triggered only after trader escalation. With leaner support coverage and limited vendor transparency, Mean Time to Resolve (MTTR) remains high – even for non-catastrophic incidents.

Solving these challenges requires more than better tools. It requires a different operating model.

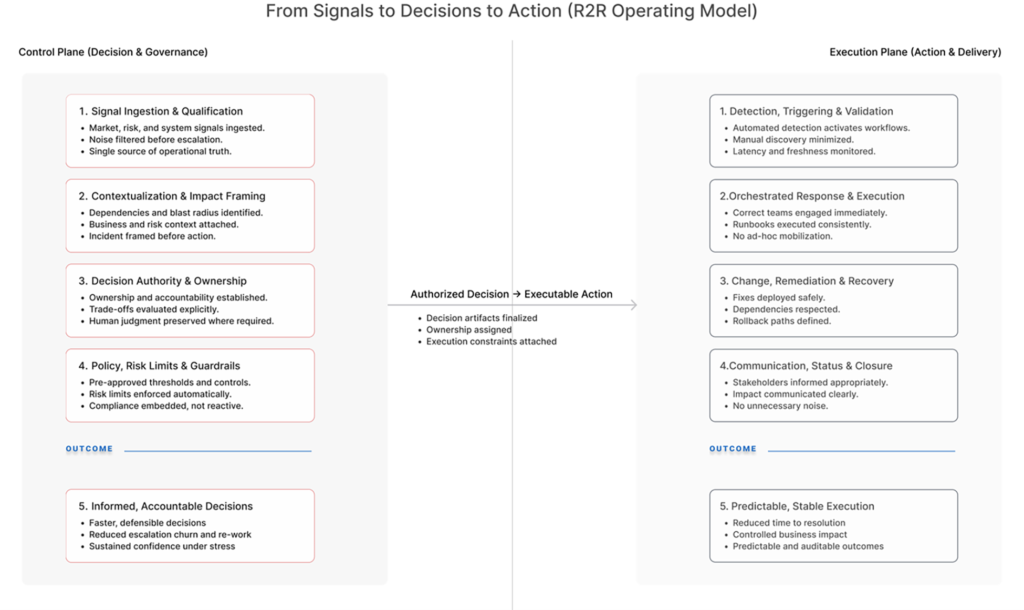

Introducing R2R: A Modern Operating Model for Front-Office Resilience

R2R is not a tool or a platform. Unlike traditional resilience initiatives that focus on tooling upgrades or isolated automation, R2R reframes Front-Office resilience as an operating-model discipline – integrating telemetry, AI, governance, and decision-making into a single, business-aligned framework.

Designed for the constraints of Tier 2 and Tier 3 trading environments, R2R shifts institutions from reactive incident response to proactive, resilience-driven operations.

R2R is built on seven architectural pillars, implemented through a set of foundational and operating capabilities, illustrated below:

Figure 2. Illustrative operating-model view showing how the seven R2R pillars are realized through foundational and operating capabilities

- Unified telemetry across pricing, risk, execution, and market data systems

- Real-time dependency mapping across the trading chain

- AI-assisted diagnostics based on business impact

- Automated remediation playbooks to shorten recovery times

- Business-aligned monitoring tied to trading outcomes

- Integrated incident orchestration across teams

- Continuous resilience analytics and improvement

Together, these pillars enable Tier-1-level resilience.

How AI Enables Proactive Resilience

AI reshapes Front-Office resilience by shifting teams from reactive diagnostics to predictive, business-aligned operations. Models detect anomalies before they escalate, correlate signals across pricing, risk, and execution systems, and prioritize issues based on trading impact, risk exposure, or regulatory relevance.

This reduces Mean Time to Detect (MTTD) and Mean Time to Identify (MTTI), allowing teams to intervene earlier as AI-driven workflows move into production.

Regulatory Alignment Without Added Complexity

Regulators across the EU, UK, and US are converging on a common expectation: Front-Office systems must demonstrate end-to-end operational resilience. R2R aligns naturally with frameworks such as DORA, the UK operational resilience regime, Reg SCI, and SR 11-7 by improving traceability, dependency awareness, and governance.

A unified telemetry and AI-assisted operating model makes it easier to demonstrate control and accountability without introducing additional compliance overhead.

A Practical Path Forward

Institutions do not need a large-scale transformation to begin improving Front-Office resilience. Practical progress can be made through four focused steps:

- Consolidate telemetry into a unified, normalized layer

- Build real-time dependency maps across pricing, risk, and execution

- Introduce AI-assisted diagnostics with clear governance

- Establish cross-functional operating models spanning technology, risk, and trading

Together, these steps form a pragmatic foundation for a more adaptive and resilient Front-Office.

Conclusion

Front-Office resilience is no longer a technology challenge – it is an operating-model challenge. As markets become faster, systems more interconnected, and AI increasingly embedded in execution workflows, resilience will be defined less by tooling choices and more by operating-model maturity.

R2R provides a practical, regulator-aligned framework that enables Tier 2 and Tier 3 institutions to move from reactive incident response to engineered resilience. Firms that recognize this shift early will reduce operational risk while gaining a structural advantage in execution quality, client trust, and long-term competitiveness.

Author Bio

Vishal Gupta is a capital markets technology leader specializing in front-office architecture, operational resilience, and AI-enabled operating models. He works with Tier 2 and Tier 3 institutions to modernize trading, risk, and market-data platforms under real-world budget, regulatory, and operational constraints. He is the author of the R2R (Reactive to Resilient) framework, which reframes front-office resilience as an operating-model discipline rather than a tooling challenge.

Subscribe to our newsletter