By Nathan Snyder, Head of Banking and Capital Markets Consulting, DXC Luxoft.

By Nathan Snyder, Head of Banking and Capital Markets Consulting, DXC Luxoft.

Many financial institutions find themselves at a crossroads as they take stock of concerns about their ongoing financial viability. As they attempt to return to some semblance of normal in the wake of the pandemic, many banks need to decide how to respond to the realization that their return on equity is lower than their costs of equity.

This situation has been building since the financial crisis of 2008/2009 and the regulatory response to it, which narrowed margins and provided a new structural challenge to running a successful financial institution.Constructing a ‘Regulatory Moat’

Deemed ‘too big to fail’ immediately post-Credit Crisis, many financial institutions today are maintained in their market positions by a ‘Regulatory Moat’ – a set of regulations so onerous as to present a significant barrier to new entrants.

With their margins squeezed post-Crisis, firms were faced with a choice in order to increase returns: cut costs or pursue new revenue streams through innovation. Some banks, mainly the European ones, cut their way out of the crisis, scaling back or dropping unprofitable operations. Others modernized, adopting new digital technologies that allowed them to compete effectively and increase their market share.

Those who took the decision to cut find themselves left with inflexible, often-siloed technology estates. The capacity to address new opportunities has been reduced, creating inertia against innovation. These firms are now finding that the Regulatory Moat can no longer fully protect them from competition. For many of these institutions, the complex technology stacks they put in place are now turning into an obstacle to agility, flexibility, and time to market. Banks attempting to add new functionality experience an ever-escalating set of costs as they introduce new processes and new systems on top of technology stacks no longer fit for purpose.

Meanwhile, those who took the innovation route embraced digital ways of working that gave them the agility they needed to understand clients’ priorities and respond rapidly to market opportunities. This approach also had the secondary benefit of rationalizing and optimizing existing business processes and reducing operating costs. Continuous integration and deployment pipelines and other innovations started to reduce the human cost of maintaining the technology stack. As a result, those leaders in digitization have shown greater assets as a ratio of operating costs.

But where does this leave the group that did not innovate?

This group is now finding that rather than being considered by regulators as ‘too big to fail’ they are now perceived in the marketplace as ‘too slow to compete’. As a result, they face some tough decisions if they are to recapture their edge against their digital-focused competition.

The As-a-Service Ecosystem

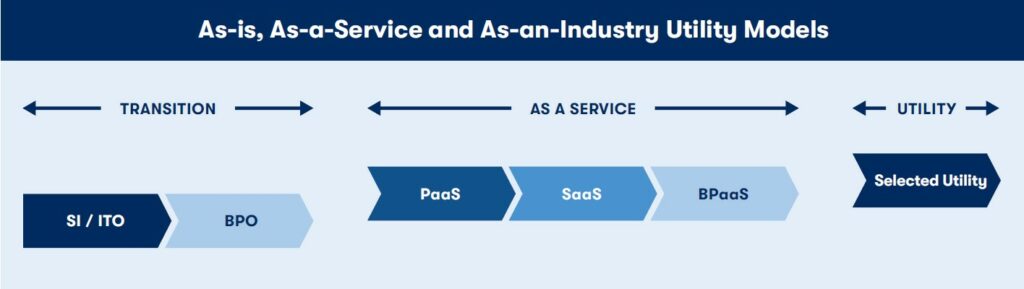

But all is not lost. Banks now have the opportunity to take advantage of a new and growing ecosystem of technology and other providers offering ‘as-a-service’ delivery of key functions.

New regulations like the EU’s Open Banking initiative have sparked the growth of small specialist companies that fill niches in the technology stack. At the same time, larger organizations are offering Business Process-as-a-Service and Utility models.

So as the demand for more agility within financial institutions grows, so too does the community of digital solution providers that can help address the challenge.

To benefit from the new availability of as-a-service solutions, a necessary first step is to ascertain what is differentiating in your organization and what is not. Once this has been established, firms should focus their attention on what is differentiating and, wherever possible, consume non-differentiating functions as a service.

For example, it may be worth considering whether key elements of the trading workflow, particularly around the middle and back-office, that once represented a competitive advantage have become standardized due to new regulations and thus a candidate for provisioning under an as-a-service or utility model. Until recently the pricing of OTC derivatives was a proprietary function, with the different valuation methodologies used by financial institutions offering a differentiating service. But under new Uncleared Margin Rules (UMR), counterparties need to either trade the derivative through clearing (where possible) or declare their valuation to the marketplace. In the event that they have a different valuation to the other counterparties, they are encouraged to reach an agreement, or both hold punitive collateral.

As of last year, more than 1,000 firms have been impacted by this rule change. Something that was once a proprietary calculation providing competitive advantage is now something where standardization provides mutual benefits.

An Innovative Attitude

Firms conducting a review of their activities need to ask whether a particular function delivers a competitive advantage. They need to focus on optimizing core profit generators, reducing time to market, and supporting innovation for better client outcomes.

For this approach to work in your organization, it is necessary to take an innovative attitude both on the differentiating side and on the non-differentiating side of the business. For non-differentiating functions, the ecosystem of partners is continually evolving. Horizon-scanning this ecosystem is a necessary responsibility of the modern CTO.

Most obviously, the innovative mind-set also applies to differentiating services. CTOs need to be creative in terms of putting in place the kind of technology stack and processes needed to support the rapid development of revenue-generating processes and technologies.

Fast Companies Succeed

Banks and capital markets firms that believe their size and scale will give them continued market domination and longevity would be well advised to look at the practices of innovative, fast companies.

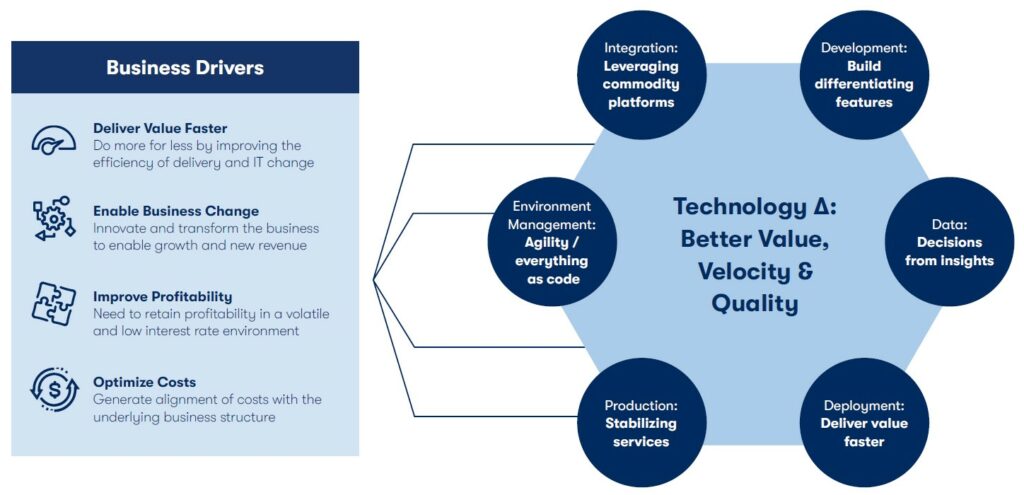

On the journey from bespoke architectures to as-a-service and utility models, it is imperative not to forget the business drivers. CTOs are expected to partner with their business colleagues to bring innovative solutions that address business opportunities.

For most firms, stakeholders’ key imperatives will include the ability to deliver value more rapidly, essentially doing more for less, quicker. They will also include the need to innovate and transform the business to support future growth, to improve profitability and to optimize costs by aligning them with the underlying business structure.

This approach necessarily involves leveraging commodity platforms to remove the burden of supporting non-differentiating technology stacks. This approach allows CTOs to focus on where technology can add significant business value and lead the changes necessary to compete effectively.

Partnership is key. To achieve these objectives, CTOs need to be partnering with both business stakeholders and external clients, as well as with the emerging ecosystem of digital service providers that your optimized technology organization is now capable of leveraging for agility and profitability.

Pulling this all together and adopting a flexible approach to partnering with as-a-service providers while focusing on core differentiators, can allow firms to deploy technology solutions that reflect desired business outcomes of future growth and profitability.

Subscribe to our newsletter