Newer financial markets firms and FinTech companies have come out strongly in favour of regulatory action on market data within the EU. In contrast, some more established players are taking the view that little or no action is needed, and any issues are the fault of the regulator in the first place. These, and other views, some of which we have already covered, have been published in response to the European Securities and Markets Authority’s (ESMA’s) July consultation paper on market data and the establishment of a consolidated tape (CT) for equity instruments.

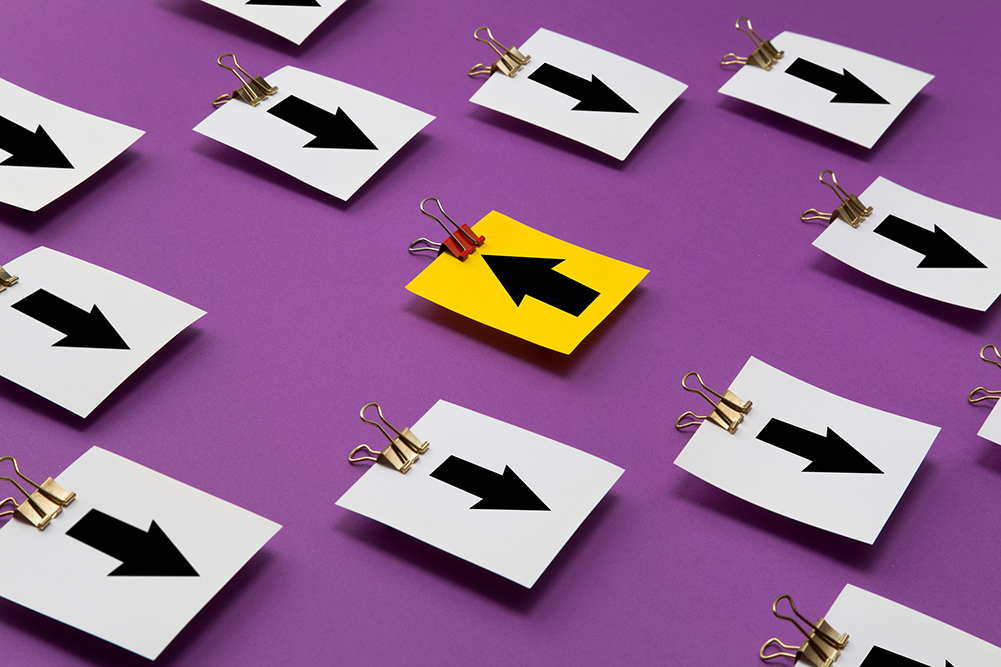

The responses make it clear that there are differences of opinion at many different levels. Certainly, there are differences between the way more established firms and newer firms view market data issues. For example, it seems that newer firms are encountering significant market data challenges. In a world where so much information is free on the internet, increased charges for market data based on use cases may seem out of sync, no matter how much sense it makes economically. As well, non-compliance with MiFID II regulatory reporting requirements could be less ‘conspiracy’ and more about the challenging nature of the IT infrastructure of many long-established financial services firms. However, the reality is that many market participants perceive current market data challenges as holding back progress.

There are also differences in how different kinds of players in the market view the data costs. Generally speaking, banks, brokers, and FinTech firms are all in favour of lower data costs. Meanwhile, the data suppliers and exchanges believe that if their data is of more value to the users, and can be used in more ways, they should be compensated for that. This can be thought of as more of a pay-per-use model.

Calling out price hikes and non-compliance

Virtu, a market making and execution services firm founded in 2008, filed a strongly-worded response to the CT consultation paper in mid-September. The firm talks about the price increases it’s seen for the data it uses. “For example, based on the LSE’s 2017 pricing schedule, Virtu Europe paid a total of £60,560 for all non-display data usage, expressly including use in a trading venue. Based on the 2019 pricing schedule, Virtu Europe anticipates paying a total of £82,375 (taking into account the new trading platform fee of £54,917) for the same data, via the same provider, the same connectivity, and received into the same single feed handler. The new fee is clearly arbitrary and opportunistic given the absence of any actual change to how the data is provided or consumed.”

According to Virtu, these price increases stem from a number of factors, including: “(1) Exchanges increasing their prices year-on-year for pre-existing market data use cases; and (2) Exchanges expanding the list of chargeable use-cases, giving rise to new fees. For example, a number of exchanges have introduced a new fee for use of their market data in a trading venue…and for ‘other applications’ such as risk checks. Certain exchanges have also taken what used to be a single fee for all non-display usage and broken that out into separate fees for non-display usage in different applications, meaning that a market participant with a profile such as Virtu’s is forced to pay multiple times for the same data set.”

Pricing isn’t the only complaint that newer organisations on the block have. Regulatory reporting FinTech Oktris says many financial services firms are just not abiding by the rules of MiFID II. “Obtaining information on prices for data from UK based APAs [Approved Publication Arrangements], let alone how they were arrived at, is a time-consuming process taking several man days of effort, and even when it is understood what has been requested and the ‘answer’ provided, the picture is still unclear in many cases. Oktris has email trails from several APAs spanning months and trying to obtain this information. Oktris has approached very few trading venues but has found a similar pattern.”

Oktris goes even further, saying: “The data is provided. But it does not meet the requirements. In particular, RTS 13, article 14 machine readability is often neglected. For example, data can be hidden behind user logins needing a username and password – i.e., not directly and automatically readable by a computer. Once through the logins, the manual retrieval mechanisms are presented in such a way as to obfuscate the underlying code requests made to obtain the data – so they are harder to replicate.

“Additionally, the requirement to provide instructions on accessing data in a machine readable manner mandated under article 14 are either completely absent (most cases), or vague to the point of being useless. For four out of six UK based APAs, Oktris can provide evidence of lack of compliance, and even direct obstruction (which was raised with the UK NCA).” These submissions from Oktris and others are strongly worded.

Responding in kind

On the other hand, exchanges and some data vendors argued in their responses that the reality of the situation is much different to how it is being portrayed by others. Says Refinitiv: “There is confusion between rising costs associated with increased usage and actual pricing of data, in this case exchange data. Our view is that increased usage of data is widespread and leading some participants to assume that data is becoming more expensive. The reality is more nuanced and there is a mixture of factors at play. As we will set out, the industry is making more use of the data it is already consuming; it is consuming an increased variety of data; and as markets accelerate, so does the volume of data produced by a venue on any given day. All this contributes to an increased spend on data, but it is not necessarily the case that data is becoming more expensive.”

Similarly, the London Stock Exchange says that it “agrees with ESMA’s assessment that ‘the price of market data may not have increased overall…[and] there are some indications that in areas and for use cases where there is high demand for market data, fees have increased.’ Based on our own experience, we agree with ESMA’s observation that there has not been a blanket increase in prices while pricing structures post MiFID II have changed. Although certain prices have increased, this has been in line with use cases under the RCB standard reflecting the higher value gained by customers for those products.”

In addition, the LSE states: “ESMA appropriately recognises the increased commercial value which data users are realising from certain added value services and that the corresponding commercial basis of fee setting has reflected this. It is the right approach to consider evolving data use cases alongside price developments because it makes sense to align commercial policy to use cases.”

Meanwhile, IHS Markit says the reason why APAs do not work properly is the fault of the regulators. “The transparency provisions in MiFIR included measures designed to improve access to, and reduce the costs of, the existing market data offerings from trading venues (TVs) and APAs – ignoring the fact that these data offerings were not designed nor priced for use in consolidated form. Due to an inherent lack of standards and inadequate OTC trade reporting rules, the data provided by TVs and APAs is of insufficient quality. Each TV and APA source operates a different model and represents the activity differently preventing users of consolidated data from accurately distinguishing the collective, accessible liquidity across the underlying markets.”

All of this gives ESMA quite a lot to think about before it publishes its final review report for submission to the European Commission in December 2019.

Subscribe to our newsletter