By Steve Grob, Founder, Vision57.

By Steve Grob, Founder, Vision57.

I spent the summer reflecting on the challenges of legacy technology stacks (or LegTech for short) within our industry.

It’s a problem that has blighted our industry for years and it is only going to get worse as New Tech (AI anyone) leaves Trad Tech jogging in its smoke. Now multiply this problem by T+1, 24×7 trading and DORA regulations and the pain and business declivity go to 11. For legacy vendors, it is a real problem too. Their traditional stickiness is coming into question as next-gen traders demand better tools to create better outcomes for their own clients. Now, these vendors may think they can M&A their way to coolness but just redoing the website following an acquisition with the head office corporate colours is the easy bit. Delivering a totally integrated replacement stack made from separate acquisitions is hard. Different individuals must come together to understand each other and their respective tech. Then they must figure out a way to bring it all together for their client. It’s a bit like 5 kids bringing different Lego kits to a party and collectively trying to build a single Death Star, but with no instructions.

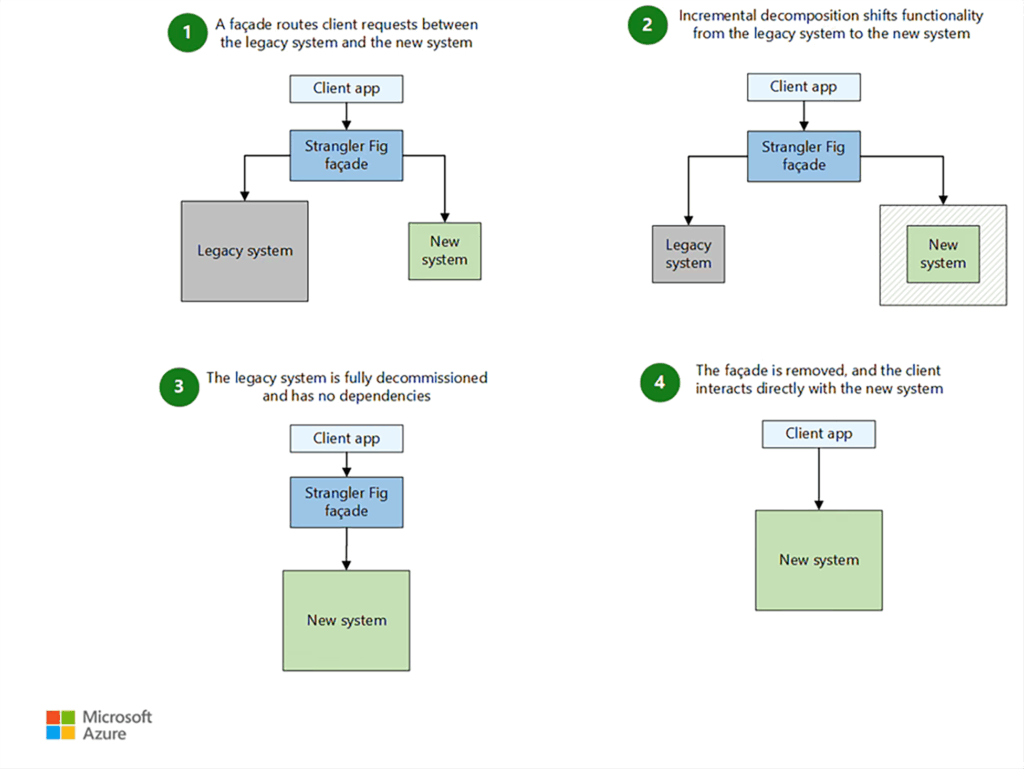

And then, thanks to my great industry friend Loreta Bahtchevanova from Rapid Addition, I came across the Fig Strangler. The Fig Strangler could be a malevolent character from a Dickensian novel, A WWE wrestler or possibly a bizarre serial killer in a new Netflix box set. But it’s none of these and is, in fact, a real plant that has a clever way to get ahead. It germinates in the canopy of another tree, which not only gives it early access to sunlight but also enables it to use its host for water and nutrients until its own roots reach the ground. Eventually, it kills its host and opens the canopy, creating light gaps that allow other species to grow – a sort of ecological ripple effect.What does this have to do with LegTech? – Well, loads. Check Microsoft’s documented Fig Strangler methodology for replacing LegTech and erasing technical debt. Essentially, the approach is based upon planned incremental replacement of parts of the LegTech stack. A facade or Proxy intercepts requests to the old system and routes the request either onto the legacy platform or to new services as they are developed.

The growing buy-and-build movement, whereby financial firms buy non-differentiating tech and then add their own IP on top, is part of the solution. The best of both worlds – but it requires clinical precision by the client to make the right decisions and pick the right kit.

One thing is for certain, though – taking a legacy mindset to solving the LegTech problem is always going to cause trouble. I see too many financial firms conduct exhaustive (and expensive) audits of their existing LegTech as a precursor to finding a replacement. A much better approach is to get business leaders and other stakeholders together and agree on what type of business they want to become in 5 years. The lowest low touch, white glove high touch or anything in between. Then work backwards, describing the functional capabilities your new vision must have and then look at your existing tech stack in this light. Now, it’s time to get your arborist geek on and plant your fig strangler.

There are a bunch of different varieties of fig strangler technologies to choose from, and I will name-check a few below.

Rapid Addition’s Hub platform is a good place to start. Its message management platform and low-code interface can wrap around many legacy tech stacks. Rapid’s CTO Deepak Dhayatker said that the Fig Strangler Pattern gives firms a safe, controlled way to modernise legacy technology.

“Our platform has built-in support for this approach, whether that’s wrapping existing Java code as a plugin, exposing it through our Open API, or integrating other services into the RA Hub. This lets teams run old and new code side-by-side, manage the transition with feature flags, and choose the migration path that best fits their needs,” Deepak continues.

Another is Unity (which is soon to come out of stealth mode) from Quod Financial. Unity is a platform-agnostic integration layer that underpins your existing systems and gets them playing nice with each other. Medan Gabbay co-CEO of Quod describes Unity as “a single architecture where you can redefine your desk and workflows for the future”. ipushpull is another interesting firm that ingests data (external or internal) normalises it and then serves up value added information to users (on their platform of choice). Matt Cheung, CEO of ipushpull told me their approach “is to plug directly into LegTech applications, capturing the unstructured data in real time, transforming it and delivering it into the systems it needs to get to – fig strangling in action.” And of course, there is Velox which uses a technique called “server interoperability” to “wrap-and-expand” existing legacy tech. Jon Butler, Velox CEO said “with vCore, our clients can turn a negative into a positive and use their legacy estate as stepping stones to modernization”. What’s interesting is that Fig Strangler vendors understand that they need to be part of a larger ecosystem of other vendors and internal IP. Interoperability, then, is key.

Many of the technologies named above and loads of other cool ones will be on display at the A-Team Group’s Buy AND Build event taking place in London on October 2nd.

When replacing LegTech, a key issue is how to measure the success of an incremental approach in terms of ROI. Traditional ROI that captures immediate savings or revenue gain is too blunt for a gradual, fig strangler approach. So, firms are now looking at Strategic ROI that measures progress against longer-term transformational goals or Capability ROI that values the data assets, skills and cultural changes from a tech investment.

I guess the key point is that there are alternatives to just rolling over and signing up for a contract renewal. And remember, Leg Tech vendors don’t care about you; they just want your money. Provided your business keeps going so that you can pay the bills, they have no incentive to innovate. It’s a bit like Western medicine which is designed to keep you just well enough to keep paying for your monthly prescription.

So, if you want to solve a seemingly intractable business problem, then think Fig Strangler.

PS: Purists among you will know that, actually, it is called the “Strangler Fig” – forgive the poetic licence, I just preferred it my way.

PPS: If you would like to know more about this approach or get a longer list of relevant vendors, then please message me, or come and chat at A-Team Group’s Buy AND Build, the Future of Capital Markets Technology.

May all your legacy stacks be gently strangled by figs rather than strangling you back.

View the full agenda and sign up here or register below.

Subscribe to our newsletter