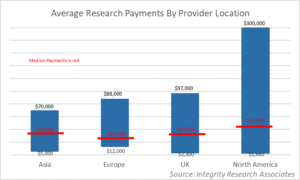

Average European research payments lagged North American research payments by over 40% last year, according to data from Integrity Research’s fourth major benchmark study of research pricing. The survey results indicate that MiFID II has had a broad (and not necessarily positive) impact on research pricing since its implementation in January 2018.

Average payments for research in Europe were $25,000, well below Asian payments (which averaged $35,000) and over 40% lower than North American payments, averaging $42,500. Average research payments in the UK, while marginally higher than those in the EU, also fell short at $31,000.

“Our latest research pricing benchmarks showed significant impacts from MiFID II along a variety of metrics,” says Integrity founder Michael Mayhew. “Those impacts are less potent outside the EU, but still notable.”

Although price taking (letting the buy-side set research values) remains a widespread pricing approach, it was no longer the most frequently used pricing model as European regulators attempted to force banks to assign explicit fees to research. In a previous survey from the same provider, conducted in early 2017, 60% of respondents used subscription fees in some form whereas in the latest survey (conducted at the end of 2018) nearly 90% of respondents charged subscription fees for at least part of their research services.

To accommodate MiFID II requirements, investment banks are now assigning subscription fees to written research (often at a low price point), while seeking to maximize overall revenues by charging premium fees for high touch services such as access to analysts – a pricing strategy that seems to have been largely successful. Premium pricing for high touch services dominated maximum client payments, with the most profitable relationships still hitting seven-figure research payments.

MiFID II has also increased the preponderance of cash payments for research. According to the survey, cash payments represented 60% of total payments, up from 46% the previous year.

“At the same time MiFID II has depressed pricing for macro research relative to other types of investment research,” warns Integrity. “Because of a loophole in MiFID II which exempts research which is publicly available, many banks in Europe have chosen to give away their macro research, forcing competitors to accept lower average payments for their macro research.”

The survey was conducted in August and September 2018 and included 140 respondents from 24 countries in Asia Pacific, EMEA and the Americas.

Subscribe to our newsletter