By Kwame Frimpong, Regulatory Product Manager at Wolters Kluwer FRR.

By Kwame Frimpong, Regulatory Product Manager at Wolters Kluwer FRR.

With the implementation of the new Investment Firms Prudential Regime (IFPR), the FCA is aiming to streamline and simplify the prudential requirements for solo-regulated investment firms in the UK. While key details of the new rules remain to be finalized, panellists joining me on a recent Wolters Kluwer webinar, hosted by A-Team Group, emphasized that the IFPR represents a major change for UK investment firms, making it critical that firms act now to adequately prepare for the new regime.

Under IFPR, which takes effect in January 2022, regulated entities will need to prepare for changes to own funds, liquidity and capital requirements. The other panellists on the webinar – Laurence Blake, Head of Risk at Jane Street Financial; Alan Sievewright, Deputy CFO at Baillie Gifford & Co.; and Andrew Lowin, Technical Director, European Financial Services Regulation, Compliance & Regulatory Consulting, at Duff & Phelps – acknowledged that UK regulators were still working on details, but suggested that much of the requirement will resemble the EU’s own IFD/IFR, due to come into effect this June.According to an audience poll taken during the webinar, only 11% of attendees had not yet started their preparations. One-third of respondents had initiated their IFPR project, and more than half were either conducting analysis and design for their response or were looking for a market solution.

The UK regulation will apply to all MiFID-authorized, Collective Portfolio Management Investment (CPMI) firms (i.e., UK UCITS ManCo and Alternative Investment Fund Management Firms permitted to undertake Additional Activities) and their UK parents and supervised firms, as well as non-small and non-interconnected firms (non-SNIs) and Class 2 firms. Panellists said firms need to understand their classification under IFPR, and suggested they refer to the FCA’s June 2020 discussion paper (DP 20-02) and first consultation paper on the topic (CP 20-24), and also check the EU rules on the EBA website. A second FCA consultation paper is due at the start of Q2 and will expand on client orders, assets under management and so-called K-factors governing client risk.

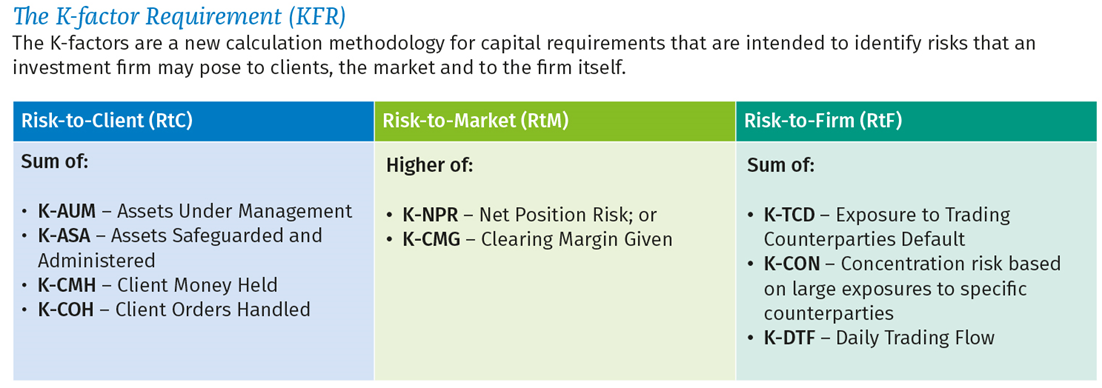

On the webinar, I explained that K-factors take new approaches to calculating capital requirements for regulated investment firms, with methodologies aimed at identifying risks that the firm may pose to clients, to the market and to itself (see diagram, below).

In fact, the K-factor requirements are the most significant innovation in the new regime. They also present regulated entities with a substantial data challenge, since firms need to put in place a framework for collecting, storing and validating large amount of data they have not used before.

Investment firms will need to apply those K-factors that are relevant to their business model. The new regulation defines three categories of K-factor. The Risk-to-Client (RtC) K-factors are designed to measure proxies for business areas of the investment firm that pose risk of harm to the firm’s own funds, with four specific K-factors identified: assets under management; assets safeguarded and administered; client money held; and client orders handled.

The Risk-to-Market (RtM) K-factors apply only to firms with a trading book and that deal on their own account or on behalf of clients. Here, two K-factors have been defined: net position risk and clearing margin given. The Risk-to-Firm (RtF) K-factors are also applicable to firms trading on their own account, and focus on counterparty risk and large exposures: exposure to trading counterparties default; concentration risk (based on large exposures to specific counterparties) and daily trading flow.

Investment firms will be required to calculate the K-factors that apply to them, according to the specific formulas set out for each. Some calculations will be familiar to practitioners. For RtF, for example, the calculation is based on a simplified version of firms’ counterparty credit risk (CRR) calculation as it applies to derivatives transactions and the K-CON is identical to current rules for large exposures under CRR.

But firms will need to put in place mechanisms for collecting the information they need to ensure they have the required data points covered under the regulation. Firms need systems and processes to collect, store and validate large amounts of data that they would not previously have had to do for CRR.

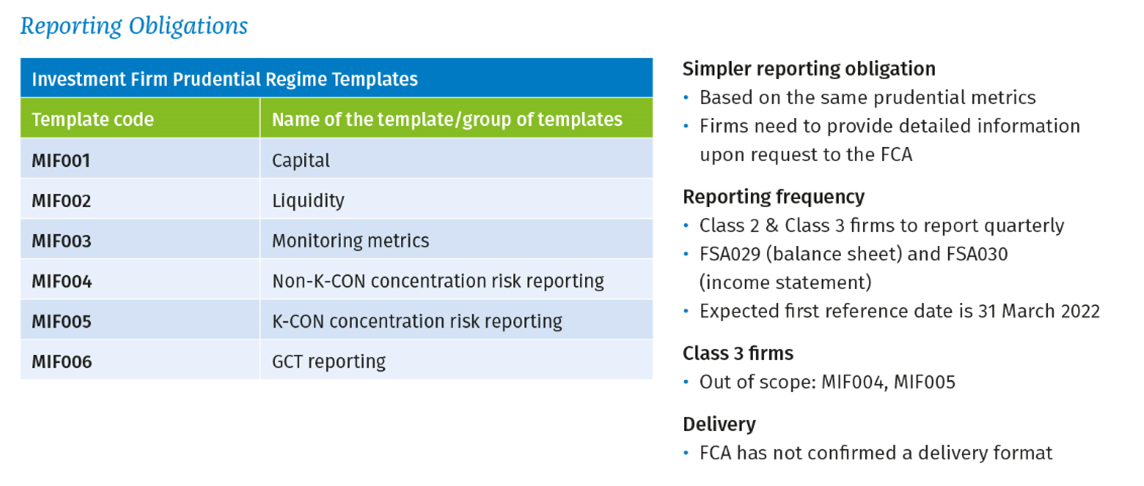

In addition to understanding the K-factors, it’s important for firms to understand their classifications, and how that classification may change if they cross capital requirement thresholds, since this may trigger the application of different sets of K-factors. The new regulation introduces changes to firms’ regulatory reporting obligations. Reporting is simpler in the UK, although the underlying calculations are in line with the EU (see diagram, below).

On the webinar, we discussed several key challenges posed by IFPR, the first of which is to understand the regulation and how to apply it to your firm. One panellist mentioned that his firm had discovered elements that were not clear and sought external advice on these.

Another challenge is putting in place the appropriate systems to calculate some of the K-factors. This must be accurate and auditable, and capable of daily risk management under IFPR’s Internal Capital & Risk Assessment process (ICARA), which is new to markets, clients and firms, and aligns potential harms to firms’ own activities.

In terms of what actions firms should be taking now, the panel acknowledged that firms have yet to have sight of a final text with nine months to compliance. Panellists urged attendees to read up on the FCA’s guidance so far, as well as pending issuances expected next month on K-factors and liquidity risk, and further clarification expected in July. Audience members were also urged to scour the EU’s communications on IFR/IFD for further insight. Given the tight turnaround, panellists said they expected to see transitional provisions and forbearance on deadline day.

In the meantime, firms should be looking to identify their classification, and reviewing their own funds to identify whether they will be subject to a change in capital adequacy requirements. Although the possibility of a delay in the implementation date was mooted – the three FCA consultations and policy statements won’t be completed until late October/early November, leaving the marketplace little time to understand the rules. The panellists said firms should get on with implementation as rules come into force soon. Again, they recommended looking to the EU, as one panellist put it: “FCA rules will probably follow EU technical standards with some deviations, so firms can start implementing in line with EU draft rules knowing that not much will change.”

Subscribe to our newsletter