Why you need a mix of third-party and in-house technology, and how to get it right

By: Steve Grob, CMO, ION Capital Markets, Fidessa

Since the global financial crisis, top-tier equities trading businesses have been contending with a mounting series of challenges. Volumes have flattened. Commissions have fallen. Regulation has tightened. Meanwhile, the rise of passive investing is pushing traditional discretionary traders out of the equities market, reducing profitability for the banks.

Despite these challenges, global and super-regional banks are still persevering with equities trading and even going for growth. They still view it as a marquee business, and it’s a gateway to other profitable activities like mergers and acquisitions and prime brokerage.

But it’s tough. Equities trading has become a zero-sum game where you can only grow at your competitors’ expense. To win business, you need to differentiate yourself and add value in unique ways.

To do that, you need the right technology. But just when Tier 1 banks try to grow, they find that the software infrastructure they need to support them isn’t there. How has this happened? And what can they do about it?

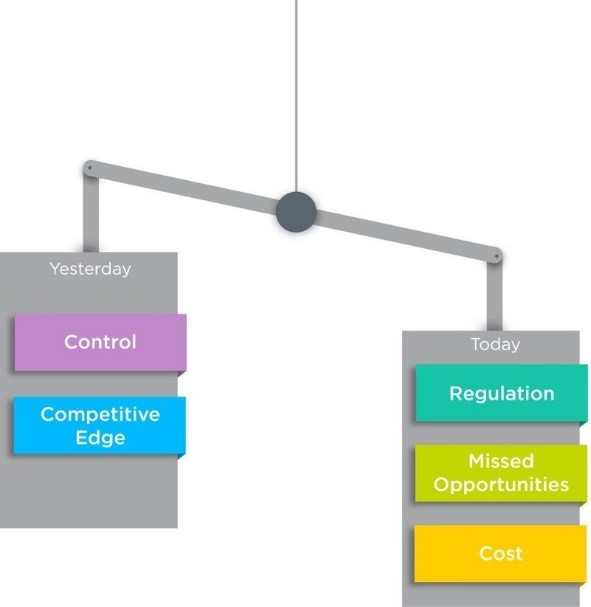

Traditionally, banks have preferred to build software in-house rather than buy from vendors. They believe building their own is the only way to satisfy their exact requirements in terms of functionality, flexibility, and control.

When you’re trading billions of dollars a day, you want to feel in control. But the sense of security that banks get from building software in-house comes at a price. For one thing, it’s wasteful. Across the industry, everybody is building systems to do similar things – connect to the same markets and liquidity pools, perform similar tasks, meet the same regulatory obligations. And that’s just not efficient.

Since the crisis, this waste has worsened as regulations have become more stringent. Boston Consulting Group reports that 80% of IT budgets are spent on maintaining legacy systems (Capital Markets FinTech White Paper, March 2018). Preparing for MiFID II swallowed massive resources and little has been left over for real innovation.

What’s more, an ingrained culture of building in-house has left many banks with tangles of legacy systems built up and bolted together over years. Updating or replacing one part runs the risk of breaking others. Replacing the whole system becomes too big and expensive to contemplate, so piecemeal development continues, compounding the problem. Paradoxically, the desire for control produces the opposite result: banks are held hostage by their legacy technology.

So building is problematic, but buying isn’t simple either. Third-party software often lacks flexibility. Sometimes, adapting it to your needs is so complicated that you might as well build your own. And ultimately, no third-party software product can ever satisfy all the needs of a large sell-side equities trading firm. Nor should it. To compete, firms have to innovate and differentiate for themselves.

The way forward is to use the right mixture of buy and build. Buy the standard, commoditized parts of your infrastructure, and focus your build effort on the specialized parts that differentiate you and give you that all-important competitive edge.

As an approach, it sounds simple. In practice, it’s hard to get right. It can be a good idea to seek help identifying where you can differentiate and forming a flexible yet coherent strategic approach to the problem.

Banks can struggle to find products and vendors they trust. To win their trust, vendors need to demonstrate global scale and operational precision. They need to provide resilient, high-performance solutions that will keep pace with regulatory changes around the world. They also need to offer technical consistency – a common application architecture based on technology that’s advanced, but not risky.

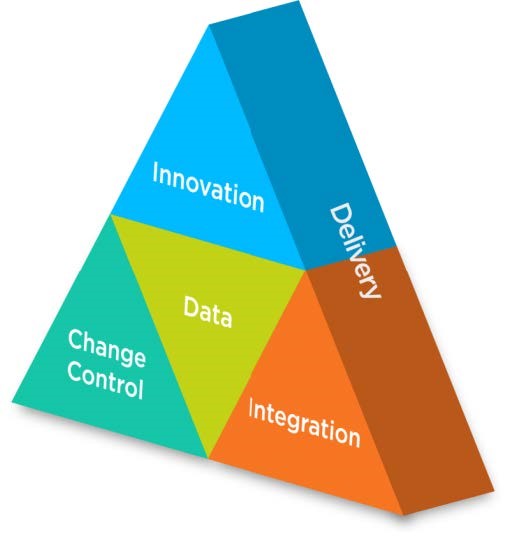

When you’ve found the right vendor, the next challenge is achieving the right blend of build and buy. That means overcoming challenges in five areas: innovation, change control, integration, data access, and agile delivery.

Innovation

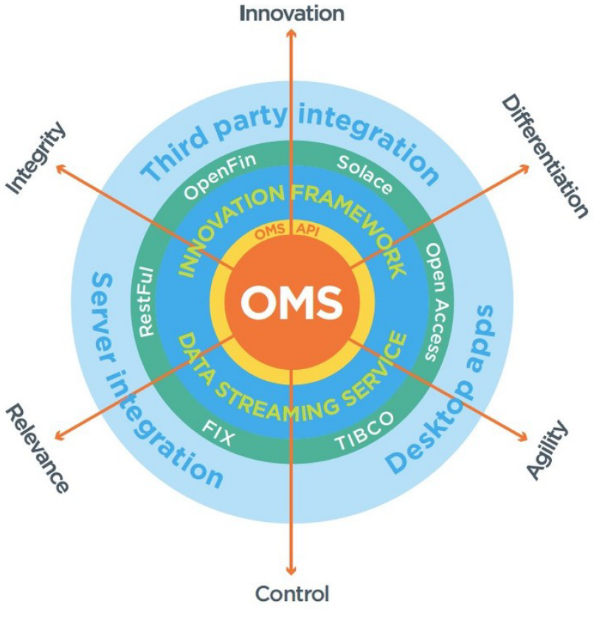

In a successful blend, you build your added value around your third-party software. Your in-house and third-party applications need to integrate and align so cleanly that your users can’t see the join.

To achieve that, you need plug-in APIs based on industry-standard languages such as Java. APIs allow you to build plug-ins that store and retrieve their own data along with data from the third-party platform. They also ensure that upgrades to the third-party software are smooth and seamless, just like your smartphone apps. The following figure shows an example of how these pieces can fit together:

Change control

We’re now living in a self-service world. When it comes to trading platforms, banks expect to deploy urgent, highly visible changes themselves when necessary, even for third-party software deployed using a managed services model.

How can you get that level of control with a mixture of buy and build?

- Use an Enterprise Service Bus (ESB) such as Solace to deliver data.

- Use tools such as OpenFin to ensure your new apps can slot together with your existing ones. FDC3 is one example of how such tools are being taken forward collectively by the industry.

The goal is a platform where standard components and services work together, and the components that sit on top, whether they’re bought or built, simply plug in.

Integration

Integration is one of the most complicated aspects of adopting a new application. Equities trading firms have complex systems where changing or replacing any component can affect many others.

Using a vendor messaging platform such as TIBCO, Solace, or Informatica can make integration easier. But it doesn’t solve the problem of linking specific events with the correct data fields. The real solution is a comprehensive toolset:

- Standard input and output APIs, which you can enrich for each customer.

- Protocol adaptors for FIX, Solace, TIBCO, Informatica, and so on.

- Contemporary interfaces, such as REST.

- Dynamic tools that enable you to perform your integration on a self-service basis.

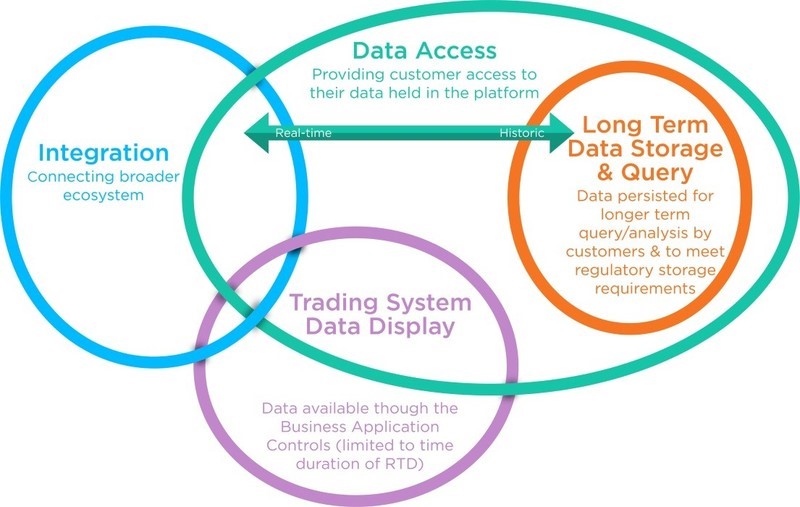

Data access

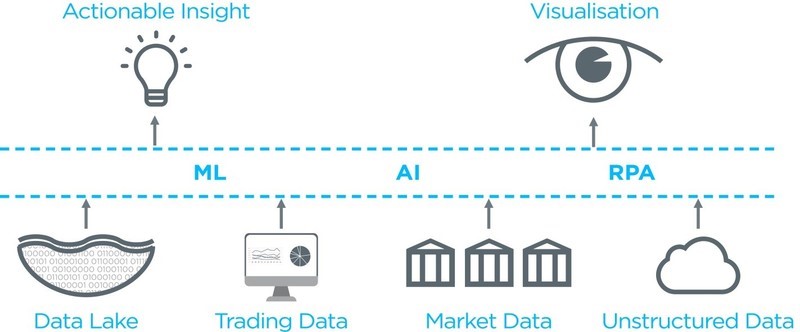

In today’s smart, connected world, data is everything. For equities trading firms, the ability to combine data sources and types is crucial to having a competitive edge. And in a future shaped by AI and machine learning, the importance of connected data will only grow.

Third-party trading applications must let a firm access its own data. That’s a basic must-have. A firm also needs the ability to:

- Import transaction datasets for integration with other platforms. This is best achieved with lightweight tools, self-service, and conformity to protocols such as REST.

- Access the vendor platform data from programming environments such as Python or R.

The capital markets industry generates vast amounts of data that banks could be using to transform their businesses for the better. To unlock its power, you need to bring together structured and external data. For example, you can combine trade files and market prices, and a number of firms now use Twitter or other unstructured news feeds to gain insight into why prices in a particular stock are moving. Then you need visualization tools and machine learning to turn that data into actionable insights.

Agile delivery

Developing a product isn’t only about building code. It’s also vital that upgrades reach users fast. For that, you need to be agile.

First, you need agile product development. The philosophy of agile is about frequent, regular product updates, continuous improvement, and user needs and feedback. It’s made possible by practices such as DevOps, DesignOps, lean, continuous integration, and automated testing and release tools.

Second, you need agile deployment so that product updates can go live to users as quickly as they’re developed. To achieve that, you need:

- Componentized, loosely coupled architectures, so you can upgrade one component of your platform without breaking others.

- Automated regression testing, so you can find any issues quickly and cheaply.

In today’s harsh environment, differentiation is the key to growth. Technology can be a vital source of this differentiation, but the winners will be the banks with the smartest in-house technology teams, not necessarily the largest.

By finding the right blend of build and buy, you can target your development resources where they deliver real value, break free of outdated legacy technology, and create a solid, scalable platform to grow your business. Firms that adopt this approach will inevitably gain market share over those that don’t.

Subscribe to our newsletter