By: Paul Gibson, business consultant, and Nam Tran, data management specialist, Sapient Global Markets

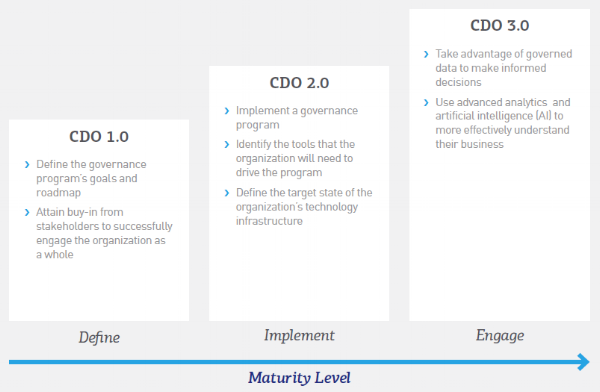

At a recent event, HSBC Group chief data officer (CDO) Peter Serenita set an interesting tone with opening remarks discussing how far the industry’s data management capabilities have come and how much further they have to go. The benchmark for this statement comes from the three stages a CDO must work through to implement a fully functional data management structure.

Depending on the size of the organisation and its political landscape, CDO 1.0 should take anywhere from three months to one year to implement. It is easy for companies to want to speed through it, or move past it all together, before CDO 1.0 is fully ingrained in the organisation.

Data management functions have a tendency to shift toward investing in the latest governance tools (CDO 2.0) instead of focusing on the basics, such as establishing a sustainable data governance framework (CDO 1.0) in which people are responsible for owning the data assets that reside throughout the organisation.

Impatience to move to CDO 2.0 or further before establishing a baseline for CDO 1.0 is the fundamental reason why firms are still unable to leverage their data assets to deliver close to their potential value. It stems from the need to prove the value of the governance programme, which can be challenging as firms face pressure to compete with new, innovative firms, while juggling greater cost and compliance pressures.

Firms that are able to organise and govern their ever increasing data could turn it into a revenue-generating activity. This requires efficient access to clean, accurate data for greater insight generation through a properly governed and centralised organisation backed by policies, standards, transparency and collaboration. Those that have begun experimenting with new technologies before fully achieving CDO 1.0 will ultimately struggle to get beyond data quality and compliance issues.

Re-establishing a foundation

A key initial objective when evaluating the governance framework within an organisation is understanding the current state. What is the single source of truth for a particular asset? What does the flow of information from sources and destinations look like for an asset? Who is responsible for the datasets? These fundamental questions take time to answer. Organisations that lose momentum and interest and move onto the next stage of CDO before they are ready will find they have a limited number of datasets they can rely on for value generating activities.

How can an organisation govern an incomplete picture? How can it look to improve its technology without fully understanding the current landscape? These are just a couple of questions that can plague an organisation should it move hastily past its maturity level.

Whether it’s responding to an inquiry or providing an ad hoc report, organisations need the means to meet client requests as quickly as possible. Delivering the right information at the most appropriate time only occurs when data governance is properly established because it can identify who owns the data and in which source system it resides.

Imagine a scenario in which a client contacts the organisation to seek insight into the types of investments made on their behalf for the year. Will the client representative know exactly where to look and who to ask for this information, or will the representative have to recruit multiple employees to analyse and produce that report for the client? In today’s data landscape, it is the latter that tends to happen more frequently.

To move beyond CDO 1.0 in a maintainable way, organisations must establish a solid governance agenda, including a methodology to identify an owner to every piece of data so that people know the responsible party when they need access or when they need to resolve errors or inconsistencies.

This isn’t easy. It’s a challenge for many to achieve data governance buy-in at a time when firms are focused on more direct bottom-line-driven activities to counter shrinking margins and increasing competition. The key is in stories. For the data function to receive the appropriate investment, CDOs have to be able to tell the stories about how their function is moving the organisation forward.

CDO 1.0 and beyond

Today’s CDOs need to champion new opportunities, while also staying focused and firm on the governance track. CDOs must work closely with their teams to ensure alignment or else the teams will spend months trying to implement new tools without proper structure. This process starts by making sure the right story is being communicated and finding the appropriate set of tools for their organisation’s data governance maturity level. With them in place, a CDO can show key stakeholders how data can make processes more cost-efficient and customer experiences more personal. Showing incremental value in this way will allow CDOs to maintain support for their programme.

CDOs should place the governance programme at the front and centre of their priorities by holding the team’s direct reports accountable to the programme’s deadlines. While CDOs will be pulled in multiple directions, governance must remain their key focus. Those that fail to establish a solid governance foundation and follow the roadmap to CDO 3.0 will not be able to maximise the value of the tools that can truly make a difference, such as predictive analytics, artificial intelligence and whatever comes next.

Subscribe to our newsletter