Institutions are facing huge operational burdens as they ingest huge volumes of data, demand real-time analytics and face stringent regulatory scrutiny. Consequently, the new data landscape is rendering traditional data management systems inadequate for the growing number of use cases to which data is being deployed.

This has necessitated a shift towards modern data management with an emphasis on automation and streamlined, artificial intelligence-powered processing.

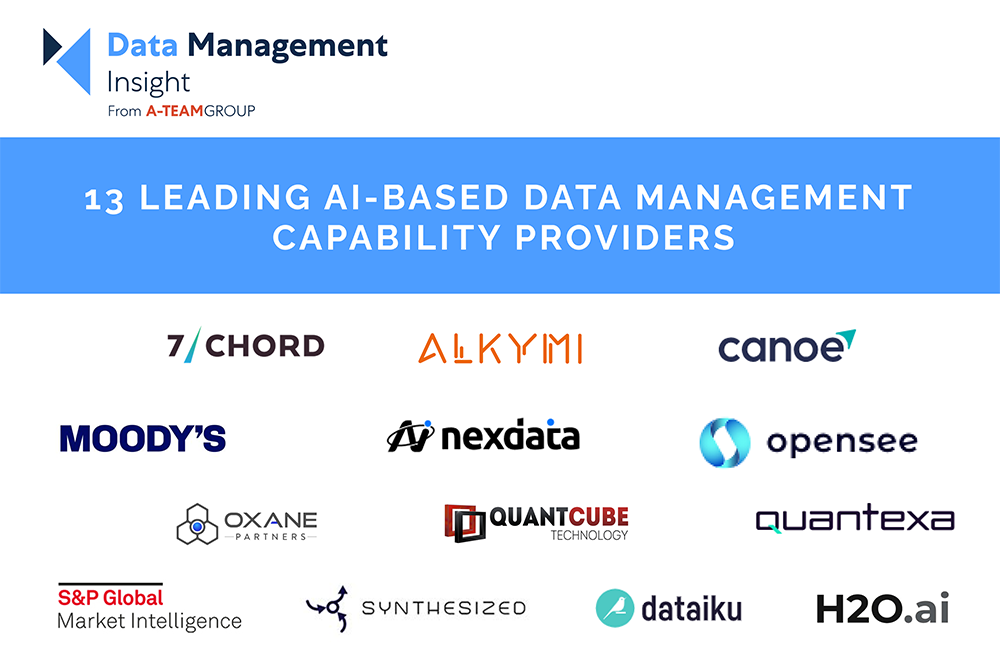

The core operational challenge is not merely storing data but transforming vast quantities of unstructured, siloed and high-frequency data – from legal documents to tick-by-tick market feeds – into a structured, governed, and decision-ready asset at scale.This article profiles leading vendors enabling this transformation. This list is taken from our advisory board’s shortlist of nominees and votes for the Data Management Insight Awards USA 2025 award for Best AI-Based Data Management Capability.

Winner, Data Management Insight Awards USA: Best AI-Based Data Management Capability, 2025

Alkymi provides an end-to-end AI-powered platform designed to automate unstructured data extraction and transformation from private markets and complex financial documents. Its use of a combination of proprietary Machine Learning (ML) and Large Language Models (LLMs) is specifically tailored for the highly unstructured and nuanced data found within the private equity and alternatives ecosystem. The platform seeks to eliminate the slow, costly and error-prone manual processing of investment documents – such as capital call notices, quarterly reports and financial statements – freeing up operations and investment teams to focus on client service and strategic decision-making.

7 Chord offers predictive pricing and advanced analytics, primarily for the fixed-income credit trading market, powered by its proprietary AI platform, BondDroid. The company’s AI-native engine synthesises signals from a vast array of vendor, public and proprietary client data to generate real-time predictive pricing for complex credit instruments. It is designed to address the liquidity and transparency challenges in less liquid markets, such as corporate bonds, by providing institutional traders with continuous, data-driven pricing and risk vectors to inform trade execution and portfolio decisions.

Canoe Intelligence offers an AI-driven data management platform to automate the ingestion, extraction and harmonisation of data from alternative investment documents. It specialises in alternative investments (private equity, hedge funds, venture capital) and a continuous learning model enables it to handle the immense variety and complexity of reporting documents specific to the Limited Partner (LP) workflow. It strives to solve operational bottlenecks for asset owners and wealth managers by transforming fragmented and unstructured PDF documents into clean, structured and auditable data, significantly reducing data latency and operational risk in alts management.

Dataiku provides a centralised platform for everyday AI, unifying data preparation, machine learning development and model deployment across the enterprise. The platform is designed to democratise AI, enabling data scientists and business domain experts, such as risk analysts or traders, to collaboratively build, deploy and manage predictive data pipelines and governance frameworks. It is built to break down the technical and organisational silos between data teams and business units, accelerating the time-to-value for complex data science projects – from trade surveillance to credit risk modelling – while ensuring model governance is maintained.

H2O.ai offers an open-source and proprietary AI cloud platform designed to democratise AI creation through its Automated Machine Learning (AutoML) capabilities. Its Driverless AI platform uses AI to automate the entire data science workflow – including feature engineering, model validation and tuning – accelerating the development of high-accuracy, transparent ML models to help financial institutions develop and deploy robust AI models for critical functions like fraud detection and credit-risk scoring.

Moody’s embeds advanced AI and Generative AI (GenAI) capabilities into its suite of risk, credit and compliance solutions for financial institutions, leveraging its proprietary data moat. It uses AI to generate predictive insights, automate credit memo creation and enhance early warning systems for loan monitoring. By shifting risk management from reactive to predictive by automating complex, data-intensive research and analysis workflows, it aims to provide analysts with as much as 30 per cent time savings.

Nexdata is a market data partner, specialising in curating, labelling and providing AI-ready datasets for AI/ML model training. Its focus is on the foundational data layer, offering specialised data annotation and collection services that ensure the quality and bias mitigation necessary for training production-grade AI models in finance. It aims to provide vast, accurately labeled and domain-specific data.

Opensee provides an AI-native data management and analytics platform tailored to handle the high-volume, granular and historical data needs of risk, trading and finance teams. Its architecture allows for real-time access and interactive analysis of full-resolution data, including billions of data points, directly addressing the scalability and performance issues of traditional data warehousing for regulatory reporting. The platform enables financial institutions to meet demanding regulatory requirements and generate decision-grade insights by unifying live data ingestion and semantic data modelling for audit-ready, explainable metrics on demand.

Oxane Partners offers an integrated technology and services platform focused on data management and investment servicing for alternative and credit investment managers. It combines deep domain expertise in private credit and structured finance with proprietary AI to automate data extraction, processing and portfolio monitoring workflows for complex debt instruments. The platform standardises and centralises data from disparate sources related to complex private market assets, providing a unified, front-to-back office solution aimed at enhancing portfolio transparency, valuation accuracy and regulatory compliance for private debt investors.

QuantCube provides real-time macroeconomic and financial insights derived from a massive proprietary alternative data lake, specialising in nowcasting – the process of predicting current or very near-future economic indicators – by deploying computer vision on satellite data, multilingual Natural Language Processing (NLP) and advanced econometric models. The company seeks to address the lag inherent in traditional economic data releases by providing high-frequency, actionable economic indicators in real-time, empowering quantitative trading and macro investment strategies.

Quantexa’s Decision Intelligence Platform leverages context-rich data to automate and augment decision-making across financial crime, customer intelligence and risk by stitching together vast, disconnected internal and external data points into a single, comprehensive Contextual Monitoring network to reveal hidden relationships and entities. It seeks to improve the efficacy of AML and KYC processes by reducing false positives, detecting sophisticated criminal networks invisible to rules-based systems and providing a unified customer view for better risk management.

S&P Global Market Intelligence (AI discovery)

S&P Global Market Intelligence integrates AI and specialised data science tools via its Kensho AI innovation hub to enhance its core data, analytics and workflow solutions across risk, valuation and supply chain. The platform combines S&P Global’s authoritative financial data and research with AI agents and GenAI, specifically to expedite the discovery and synthesis of complex market information. The platform seeks to empower analysts and portfolio managers by streamlining the research and data gathering process, transforming raw data and proprietary research into actionable insights and structured datasets.

Synthesized generates privacy-preserving synthetic data for training AI/ML models and testing production systems in financial services. Its platform uses GenAI to create statistically representative synthetic datasets that maintain the complex correlational structures of real market, customer or transactional data without exposing any personal or sensitive information. It strives to overcome the challenges of data privacy, security and access that often stifle innovation, enabling developers and data scientists to build, test and validate models faster and in compliant environments without needing access to highly restricted production data.

Subscribe to our newsletter