TradingTech Insight Trade Execution Technology The latest content from across the platform

big xyt Addresses Gap in Market After Closure of Fidessa Fragulator with XYT View

Reflecting the ever increasing problem of fragmented market data, big xyt, a provider of market data analytics, has released XYT View, an aggregated view of data that firms can use to ensure they are achieving the best possible outcomes for themselves and their clients. XYT View is a web-based tool that allows the trading community…

HKEX Pulls Out of Bid for LSE

Hong Kong Exchanges & Clearing (HKEX) has dropped its $37 billion bid for the London Stock Exchange Group (LSEG) because it has been unable to engage with LSEG management to realise the deal. While the frustration of HKEX is palpable in its withdrawal statement, there will no doubt be sighs of relief at LSEG as…

Royal London Asset Management Selects TradingScreen OEMS to Drive Returns for Investors

UK investment management firm Royal London Asset Management (RLAM) has selected TradingScreen’s cloud-based multi-asset order and execution management system to drive better returns for investors. The deal is designed to allow RLAM to trade across multi-asset classes within its £130 billion portfolio via one centralised platform, offering greater operational efficiencies and more time to focus…

Atlantic Equities Migrates from Bloomberg SSEOMS to Itiviti Platform

Itiviti has taken on another firm needing to replace a Bloomberg SSEOMS platform that is being withdrawn, this time announcing that Atlantic Equities, a US equity agency brokerage, has elected to move to Itiviti’s high touch, low touch, and post-trade suite of hosted solutions. As well as supporting Atlantic’s core trading desks, Itiviti’s solution will…

Broadridge Releases Centralised Solution for MBS Trade Assignments

Broadridge Financial Solutions has released a centralised Trade Assignment Portal (TAP) that will allow mortgage originators and broker-dealers to transform the execution of Mortgage-Backed Securities (MBS) Trade Assignments. TAP is a web-based platform designed to provide operational efficiency by automating workflow and allowing mortgage originators and broker-dealers to electronically send and receive trade assignments, thereby…

EBS Readies Next-generation EBS Direct Platform

EBS, a provider of electronic trading platforms and technology services in foreign exchange markets, and part of CME Group, has launched a next-generation EBS Direct platform with enhanced capacity and speed that will deliver round trip processing times below 50 microseconds. The platform is in beta-testing and is designed to offer faster market data and…

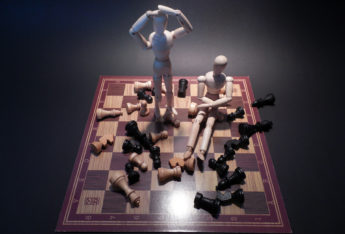

Best Execution: Putting your Worst Foot Forward?

By Justin Lyon, Founder and CEO of Simudyne. Increased regulatory pressure has raised the bar for both sell-side brokers and investment managers. In Europe, MiFID II increased responsibility on sell-side firms, with the directive ratcheting up the prevention, detection and containment of algorithms that might behave in an unintended manner and contribute to disorderly trading…

SMBC Nikko Replaces Bloomberg SSEOMS with Itiviti OMS Platform

Following Bloomberg’s decision in June 2019 to withdraw its Sell-Side Execution and Order Management Solutions (SSEOMS) and Itiviti’s offer to help SSEOMS users migrate to its OMS, SMBC Nikko London Capital Markets has successfully replaced the Bloomberg platform with Itiviti’s multi-asset OMS for high touch trading in London and added Itiviti’s middle office solutions including…

SS&C Adds S3 Transaction Cost Analysis and SEC Rule 606 Regulatory Reporting Services

SS&C Technologies is adding S3’s total cost analysis (TCA) and SEC Rule 606 reporting products to its solutions line up. The addition of S3 services – S3 is a provider of trade surveillance, analytics and regulatory reporting technology – will help SS&C clients ensure best execution of trading transactions through trade surveillance, analytics and full…

Recorded Webinar: Moving the trading technology stack to the cloud

Migration of financial apps and data to the cloud is well underway as financial institutions take the opportunity to cut the cost of running systems on premise, scale as and when required, and spin up test environments quickly and inexpensively. Moving the trading technology stack to the cloud is a different and more difficult proposition….