TradingTech Insight Trade Execution Technology The latest content from across the platform

Horizon Software Launches Composite Spreader to Automate Spread Execution

Electronic trading solutions vendor Horizon Software has launched a purpose-built Composite Spreader as part of its broader OMS roadmap, to automate the execution of multi-leg spreads. The product, which is now live and can be integrated with Horizon’s algo framework, provides clients with a user interface to define synthetic multi-leg spreads with a set of…

IHS Markit Teams Up with Wave Labs to Enhance Fixed Income Price Discovery

IHS Markit has partnered with Wave Labs, a start-up specialising in fixed income liquidity sourcing, to accelerate price discovery and deliver insights and operating efficiencies to buy-side fixed income managers. The arrangement involves plug-and-play integration of IHS Markit’s thinkFolio multi-asset investment management platform with Wave Lab’s Electronic Liquid Seeking Application (eLiSA). Sourcing liquidity in fixed…

SoftSolutions! Migrates nexRates Fixed Income Platform to the Cloud

Milan-based fixed income trading technology provider SoftSolutions! has re-architected its nexRates electronic Trading-as-a-Service platform to be fully cloud-available. In the process, the company has completed an AWS (Amazon Web Services) Foundational Technical Review, meeting strict criteria around security, disaster recovery, resilience, and operational excellence. “The main driver behind this is that most of our Tier…

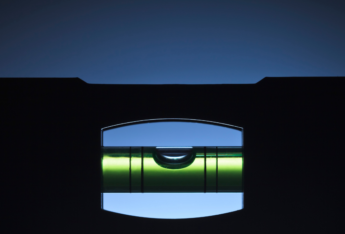

Levelling the Playing Field in US Equities

Q&A with Joe Wald, Managing Director & Co-Head of Electronic Trading at BMO Capital Markets The US equities market microstructure landscape is evolving. The introduction of Reg-NMS and the National Market System in 2005, designed to promote efficient and fair price formation across securities markets, has had many positive effects in terms of greater competition,…

Raidne Goes Live with Siren FX Benchmark

London-based Raidne has gone live with the first client for its recently launched Siren FX fixing benchmark. The quantitative FX surveillance says the independent benchmark – which was designed to offer an alternative to established fixes that have been subject to market manipulation – is being used by a European asset manager, executing through a…

Navigating the Post-Brexit Trading Landscape

By Mike O’Hara, A-Team Special Correspondent. It’s now almost four months since the UK exited the EU, and from a trading and market infrastructure perspective, a clearer picture of the post-Brexit landscape is starting to emerge, although there are still many uncertainties that lie ahead. How have market participants, venue operators and their supporting ecosystem…

State Street’s Currenex to Provide Trading Technology for New Interbank Crypto Platform

PureMarkets plans to base its new Pure Digital interbank digital currency trading platform on State Street’s Currenex, a high-performance matching engine used to facilitate trading in FX, money market loans and deposits, and precious metals. Pure Digital will offer a fully automated, high throughput OTC marketplace for digital assets and cryptocurrencies, with associated custody services….

Low-Code: The New Standard for Sell-Side Fixed Income Desks

By Vuk Magdelinic, CEO of Overbond. Low-code programming isn’t coming — it’s already here. And 2021 is the Year of Low-Code, according to IT publications such as SD Times and TechRepublic. “The worldwide low-code development technologies market is projected to total $13.8 billion in 2021, an increase of 22.6% from 2020,” according to the latest forecast by Gartner. The…

Broadridge Strikes at Front Office with $2.5 Billion Acquisition of Itiviti

In an all-cash transaction valued at €2.143 billion (approximately $2.5 billion), US-based Broadridge Financial Services this week agreed to acquire Scandinavian trading and connectivity solutions provider Itiviti from owner Nordic Capital. The deal will significantly expand Broadridge’s Capital Markets franchise by extending into the front office and strengthening its multi-asset capabilities. The fit looks like…

IPSX Creates Integrated Technology Framework Ahead of First Admission

UK-based IPSX, which describes itself as the world’s first regulated stock exchange dedicated to real estate assets, has pulled together an integrated technology environment and a set of standardised data workflows ahead of its first ‘Intention to Float’ (ITF) on its IPSX Wholesale market, scheduled for next month. IPSX has been working with a plethora…