TradingTech Insight Blogs The latest content from across the platform

A-Team Group’s Lorna Van Zyl Featured on FinTech Focus TV, Discussing TradingTech Summit London

In anticipation of this year’s TradingTech Summit London, we’re delighted that A-Team Group’s Head of Event Content, Lorna Van Zyl, was the star guest on the latest episode of FinTech Focus TV, talking with Toby Babb of Harrington Starr. In a wide-ranging interview, Lorna shares what goes on behind the scenes when putting the event…

Trends in Electronic Trading

By Jeffrey Britell, Senior Vice President – Global Network Services, IPC Systems. In the past 20 years, electronic trading technology has opened up what was a largely interbank domain to a much broader financial community that includes investment managers, buy-side and retail firms and increasingly, non-traditional, technology-led firms. From the early days of order management…

TradingTech Summit Returns to London with Focus on Digital Transformation and Innovation

The TradingTech Summit London, one of the most highly anticipated events in the financial technology industry, is back for the 12th time on 28th February at London’s Hilton Canary Wharf. The summit will bring together the leading innovators, investors, and thought leaders in trading technology to discuss the latest trends, challenges, and opportunities in this…

Pico Launches Test Lab to Enable Replication of Real-World Trading Environments

Pico, the technology services, software, data and analytics vendor, has launched the Pico Performance Lab, offering high-performance testing resources to financial services firms. The Lab provides customers with the ability to implement, simulate and test Pico’s full-stack trading technology solution, including infrastructure, connectivity, market data, trading software, critical timing services and Corvil Analytics. The Lab…

Investment Banks Can’t Afford Not to MIND the Front Office Risk GAP

By Oliver Blower, CEO of VoxSmart. A phrase heard by so many only to be listened to by so few. “Mind the gap”, synonymous with the mundane morning commuter grind, currently takes on a far greater significance for City traders travelling to work. Not dissimilar to the cost conundrum facing the rail industry recently, when…

OptionsDesk Adopts ION’s XTP Front-to-Back Suite for Exchange-Traded Derivatives

OptionsDesk, the UK options broker that provides advisory and brokerage services for retail investors, corporations, and financial institutions, has signed a long-term strategic partnership with ION, the trading, analytics, treasury and risk management solutions vendor. The deal will enable OptionsDesk to expand its exchange-traded derivatives (ETDs) capabilities by utilising ION’s XTP Front-to-Back Suite for both…

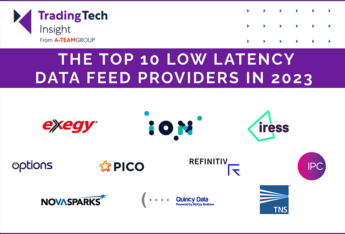

The Top Low Latency Data Feed Providers

Low latency data feeds have become a crucial component of today’s electronic financial markets. Not just for high-frequency trading firms, but across the industry. Buy side and sell side firms rely on fast, accurate market data to make informed decisions in real-time for a wide variety of use cases – from improving trading performance to…

Are You Ready for the Tide to Change for Compliant Communications?

By Jennie Clarke, Senior Manager at Global Relay, the electronic communications compliance specialists. Regulatory obligation and guidance surrounding the capture, monitoring and surveillance of digital communication channels is far-reaching and increasingly robust. The Financial Conduct Authority’s (FCA) Handbook SYSC 10A, for example, requires firms to “take all reasonable steps to record telephone conversations, and keep…

Integral Launches Trading, Custody and White Label Crypto Technology Solution

Integral, the FX technology provider, has launched Integral Digital, a full extension of its trading and client distribution platform to support cryptocurrencies and fiat-backed stablecoins. The new platform, Integral Digital, was developed in conjunction with Mint Exchange, and supports Bitcoin, Bitcoin Cash, Litecoin, Ethereum, Ripple, Stellar, CoDEX and 100+ ERC-20 tokens. Services include aggregation and…

Adaptive Launches Aeron Open-Source Community and Announces Aeron Premium

Adaptive Financial Consulting, the electronic trading technology solutions provider, has announced the next phase of development for its Aeron platform, which Adaptive acquired in February 2022, when it bought Real Logic. Since the acquisition, Adaptive has doubled the size of the Aeron engineering team. To continue with its commitment to the open-source Aeron technology, Adaptive…