By: Dominique Vande Langerijt, a consultant at Synechron

Congratulations! You are looking to join the exclusive club of Chief Data Officers (CDO), one of the most important jobs in an industry where data is everywhere. Glory and fortune await you… well they might be awaiting you… but let’s first try to figure out what it is you are going to do.

You have already realised the importance of data in the financial industry, otherwise, you would not be here. You know that our entire industry is the most virtual in the world, with dematerialised assets and much cash stored in computerised ledgers (you can hardly call the plastic in your wallet a tangible output of our work…). It’s just data. Well not just data, it is Data! And because the industry spends its days reading, writing, manipulating, deleting, aggregating, moving… data, we should be very good at it.

We should be… but we aren’t. We lose data, we manipulate data, but we don’t know why and how we did it, we can’t trace data, we have no idea who else is using our data, we use inconsistent copies of the same data throughout the firm without knowing it… Maybe someone should help us get things in order?

And that is where you come in, the soon-to-be CDO of a financial institution. You are going to put an end to this, you are going to organise this mess we made and make us do what we should have been doing all along, managing data. Managing it well that is, not just adding overhead to the diverse processes we have in our institutions, but actually sorting it out and turning this mess into neatly organised, digestible and clearly understood chunks of data.

Define your strategy

So, you set out to create a vision, expressing everything that drives you to become the CDO in a strategy:

- The business needs to take responsibility for the data

- Data needs to be coherent, accessible and of high quality

- The organisation needs to be in control of the data and its processes

- The impact of changes within a business domain should not affect other domains

- After a lot of thought, you come up with the pillars that will support your data organisation:

- Let the business manage and structure its own data

- A role- and domain-based data governance and ownership approach

- One common data language for information exchange

- Organisation-wide services for shared data

- Centralised services for measuring and managing data quality

Position yourself

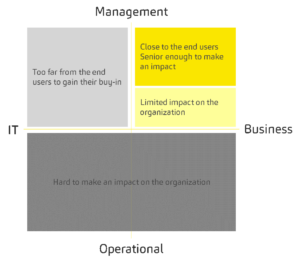

Good! Now before you start elaborating these themes and introducing them to the organisation, you should think about your own position in that organisation. What relationships across IT, the business, operations and senior management will allow your strategy to thrive? Not an easy choice, because every choice involves a trade-off. Let’s take a closer look:

Positioning yourself on the operational side will result in people perceiving you as operational, i.e. execution with no real impact on the changes in the organisation. IT might seem logical, because data is often perceived as being technical, but that would be faulty logic. You are delivering to the business and their data needs and use, because although IT might be facilitating the data, it is the business that creates, manages and manipulates the data.

So, you want to consider positioning yourself in the business organisation, close to the people you are trying to help. In order to make an impact, think ambitiously.

C-level? Great! Although the CDO is a c-level title, not many financial institutions treat their CDO as important enough to be on the board. Why is that? In a data-centric organisation, you will be the hub that ties all other board members together. No-one can function efficiently without your support, so maybe they should be rethinking their approach and put the CDO up there on the board.

C minus 1? This is where most CDOs are situated today, usually as a direct report to the chief operating officer (or chief information officer), but do consider the consequences. You will have a serious mandate and be close to the business. But you may still be running into the limitations built by the organisation before you arrived, requiring you to have approval for change from the very people who sustained those limitations until now. In reality, you will need to closely and actively manage all these stakeholders so that you have the right mandate, authority and incentives in place before you start making changes.

Go below this level and you again run the risk that you will not have the required mandate to shape the organisation into the data conscious environment it needs to be.

Achieve your vision

You have a strategy, you found your place in the organisation. The last question is, how? How are you going to ensure that you can reach your vision?

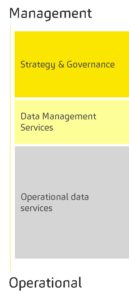

This is again a question of where you want to position your CDO team and services on the management-operations scale.

You have already set out your strategy, so there is little discussion on whether you will be taking on that part. But there are a number of practical considerations you’ll need to make in order to actually implement the programme:

- What about data management services like metadata management and master data management? Would it not make sense to manage the organisation-wide data model for data exchange? After all it is part of your strategy?

- And the inventory of datasets? Shouldn’t you keep this content-led function as close as possible to the business where the ownership lies?

- It might make sense for your team to manage the business-agnostic master data like enumeration codes, organisation structures… i.e. the data that everyone needs but no one wants to maintain.

- You’ve agreed common-sense principles such as ‘data must be sourced from the certified golden source’, but how do you monitor and enforce compliance across the IT and business? And who is going to build all this for you?

- What about operational data services? Could you provide a service for data quality monitoring? Or a data transformation service to/from the organisation-wide data model?

Do too much and you might not be able to deliver the quality you aim for or the flexibility that the business wants. Do too little and you might be perceived as an ‘ivory tower’ department, enforcing governance but delivering little value. It is all about the balance.

So how do you feel now? Are you ready to take on the role of a CDO? Change the industry, one organisation at a time?

Data touches nearly every aspect of a financial institution, making it a big job for today’s CDO to develop a vision, create a data architecture and execute a programme, but we are confident that you will get there and become the CDO that your organisation needs. And if you ever do get stuck making those choices or implementing them, you know that we are only one phone call away.

Subscribe to our newsletter