By: Sapient Consulting

Data has become one of an organisation’s most valuable assets, although many struggle to turn it into a profitable asset. In addition to lacking specialist knowledge, as well as the right tools and experience, companies often face challenges with the availability and usability of their data, overcomplicated legacy technologies, and a shortage of resources for analysis. Another challenge are stricter global guidelines for sharing personal information.

Recent advances in retail banking regulation resulting from the European Payment Services Directive II (PSD II) and the work of the Competition and Markets Authority (CMA), as well as regulators taking a more stringent approach on openness and competition, are forcing banks to open up their application programming interfaces (APIs). This brings new entrants to the market and allows a more open comparison of products and services under the Open Banking Programme.

These changes are designed to disrupt existing business models. Similarly, for investment banks a refocus on fee-based business activities requires a better understanding of how to service customer needs when proprietary trading is no longer profitable. In the face of these changes, organisations will have to come up with innovative ways to find value for their customers.

Strategies for data monetisation

When it comes to increasing the value of data, there are a number of broad strategies that companies can use to monetise data. The preferred strategy or combination of strategies will shape the direction of the analysis to focus on either one or more outcomes.

The strategic opportunities for monetisation can be classified into three broad categories:

- Reduced cost: Organisations will primarily realise cost reductions by increasing operational efficiencies. Using data to streamline technologies and infrastructure can decrease costs by improving efficiencies and eliminating duplication across systems. Data can underpin improvements in team productivity by optimising processes, which can lead to lower workforce-related costs.There are also opportunities to ease spending on data brought into a company and improving the quality of data and distribution can dramatically lower costs through better use of golden sources.

- Increased revenue: With a deeper understanding of data, organisations can gain and explore new business insights and revenue opportunities. Once data is analysed, useful insights about customer behaviour and purchasing trends can help drive more profitable services.

- Sell data: Data is the most basic commodity to sell when looking to monetise your information assets. When data is exclusive, the potential for higher revenue exists as long as there is a market for it. When data is too sensitive to sell directly, the opportunities should still be considered because there could be value in anonymising it.

Three steps to unlock the value of data

A disciplined three-step approach will help organisations understand and obtain the most value from their data.

Step 1 – Business model analysis

To maximize data monetisation, organisations should first evaluate their current business model. A good understanding of the operating landscape will help steer an organisation in the right direction as well as understanding the full context of business potential and constraints.

The key areas firms should assess include:

- Customer behaviour: Performing a behaviour analysis helps to understand the customer and their needs in more detail. The aim is to recognise what the customer is doing when interacting with the organisation and why. It also identifies certain behaviours that can help predict similar patterns in the future or among other customer groups.

- Company structure and governance: A company’s structure and governance is the link between people, skillset and desired output. This is a clear guide to the maturity and readiness of data. Companies should aim to have a disciplined data governance structure set up to help enforce a clear plan to develop required skillsets and technologies, as well as secure budget and embed trust in the data quality framework.

- Key activities and partners: Looking at the key activities the organisation is performing helps understand what data is gathered, possessed and used throughout day-to-day activities. The firm’s key partners and suppliers will also be looked at, as well as any dependencies and SLAs in place. This picture of the firms’ activities provides visibility into the data types, usage and manipulation occurring, and offers a complete view of the internal current state of all data, not just the information deemed important by regulations or record keeping requirements.

- Customer relationships and channels: In the digital age, customer relationships and channels form an important aspect of most business models. This includes how the company interacts with customers, levels of customer intimacy and self-service, as well as the overall benefits and value proposition for the customer.

- Potential boundaries: The potential boundaries an organisation could be facing need to be taken into consideration. This includes every reason why a firm cannot use its data freely, sell data or explore new business streams or growth opportunities due to regulatory, reputational, ethical or other issues.

- Cost structure and revenue streams: Organisations must assess their cost structure. Are the main costs data related and if so, why? Are key resources required to keep expensive and inefficient processes alive due to data processing that is not optimised? Revenue streams need to be understood to know what customers are paying for and what value they would be willing to pay for.

- Ideas and strategies from other organisations and Industries: Lastly, it is important to look at how organisations both within the same industry and in different industries are monetising data.

Step 2 – Data methodology

Conducting a business model analysis clarifies the context behind how and what existing data is generated and how it is used by an organisation. It sets the stage for a deeper analysis, looking closely at the overlaps and intersections of data sets to find areas of impact where the customer needs exceed the services offered. Output from the previous step provides an understanding of: customer needs; industry-wide view; assessment of how customer channels are evolving; and a competitor view.

The data methodology that follows the business model analysis contains six steps:

- Inventory of data sets: The first step is to understand existing data models. Creating a similar data set for the customer’s needs and competitor’s offerings indicates the gaps between the services the organisation is offering versus customer need, competitor offerings and industry-wide developments.

- Use cases for data monetisation: After completing the inventory of data sets, organisations can create potential use cases for the identified data models. Identifying and analysing where data sets overlap will highlight how firms can apply these elements in multiple areas or circumstances. Finding revenue generating ideas from the changes invoked during regulatory compliance is an example of this process.

- Feasibility of data monetisation: Because of constraints around the usage of data for deriving monetary value, firms should conduct a feasibility study to see which scenarios fall outside of legal and regulatory boundaries and hence can be ruled out in an early stage.

- Data preparation: Once firms know which data sets are available and can be used without restrictions, the data needs to be transformed to a state where analytics can be run, and insights generated.

- Data analytics and building data sets for monetisation: Analytics can now be performed on the prepared data to derive insights.

- Industrialise analytics: Once monetary insights are available, it’s important to industrialise the process by formalising data ingestion through production source systems.

Step 3 – Estimate the value of the data

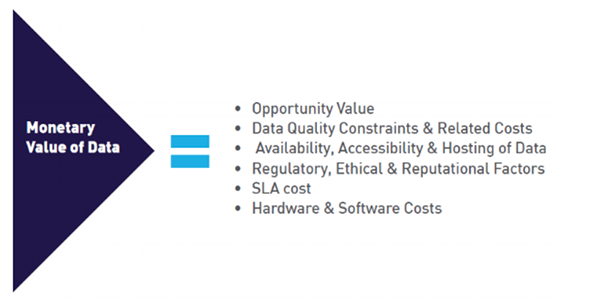

The final part of the approach relates to assigning a monetary value to the data. Measuring and improving data quality takes time and effort; similarly, making data available from legacy systems comes with a cost. Understanding the regulatory and legal impact, and any steps needed to comply with data protection regulations in certain jurisdictions, should also be considered when calculating the total value that can be extracted from the data.

To understand the potential monetary value for capitalisation, consider the equation below. Even if high-level estimates are taken, all variables in the equation must be represented in monetary terms.

This equation is only a starting point. With the insights gained in the previous stages, firms should customise the equation to their particular analysis. The opportunity value can be derived by using standard market-sizing techniques and from the previous analysis the constraints and costs to be subtracted from the opportunity value will be well understood.

Conclusion

- Data has become a critical asset for organisations in their efforts to survive and thrive in today’s fast-changing landscape, with many turning to it to unlock opportunities for competitive advantage.

- The key to success is to holistically look at a company’s business model and operating environment before beginning to understand the details of the data.

- Often potential opportunities may seem too conceptual. By leveraging the disciplined three-step approach detailed in this article, firms can separate concept from reality and successfully capitalise on their information assets.

Authors: Maria Hammargren, a senior business consultant with Sapient Consulting; Prateek Kulshreshtha, a senior business consultant with Sapient Consulting, Cian Ó Braonáin, global lead of Sapient Consulting’s Regulatory Reporting practice.

Subscribe to our newsletter