By Mark Steadman, Executive Director, Head of DTCC Report Hub Services.

By Mark Steadman, Executive Director, Head of DTCC Report Hub Services.

In the wake of the 2008 financial crisis, regulations governing the reporting of transactions across key asset classes have been implemented in major jurisdictions around the world. This complex thicket of rules is set to become even more complicated and costly for firms’ as the regulators work to revise their reporting requirements for derivatives trade reporting.

In this next wave of updates for trade reporting, regulations are expected to become more prescriptive, forcing firms to revisit and retool systems they put in place just a few years ago. For instance, jurisdictions may mandate the use of the ISO 20022 messaging standard for all trade reporting. In Europe, the European Securities Markets Association (ESMA) is extending the use of the ISO 20022 XML message scheme under the EMIR Refit of its European Market Infrastructure Regulation.

Observers expect the US Commodities Futures Trading Commission (CFTC) to do the same in a ‘Round 2’ re-write of its trade-reporting rules, followed by regulators in the APAC region, which are expected to issue their own re-writes in 2022 / 2023. Harmonization initiatives now underway between the CFTC and ESMA, while a welcome move to reduce discrepancies in trade reporting rules, may nevertheless force disruptive and expensive overhauls to firms’ reporting compliance infrastructure and operations.

Faced with this wave of changes, firms need a solution that helps manage all the latest pre- and post-trade reporting functions across jurisdictions. The DTCC Report Hub® platform is designed to do just that.

A solution to help manage trade reporting

Since the start of mandatory trade reporting in 2011, compliance with reporting requirements has been challenging and expensive. The in-house expertise required to design and implement a comprehensive reporting compliance program is in short supply. At the same time, individual jurisdictions’ rules and requirements keep changing. As a result, firms are spending a lot of time and money on updates to internal systems and processes that bring little in the way of competitive differentiation.

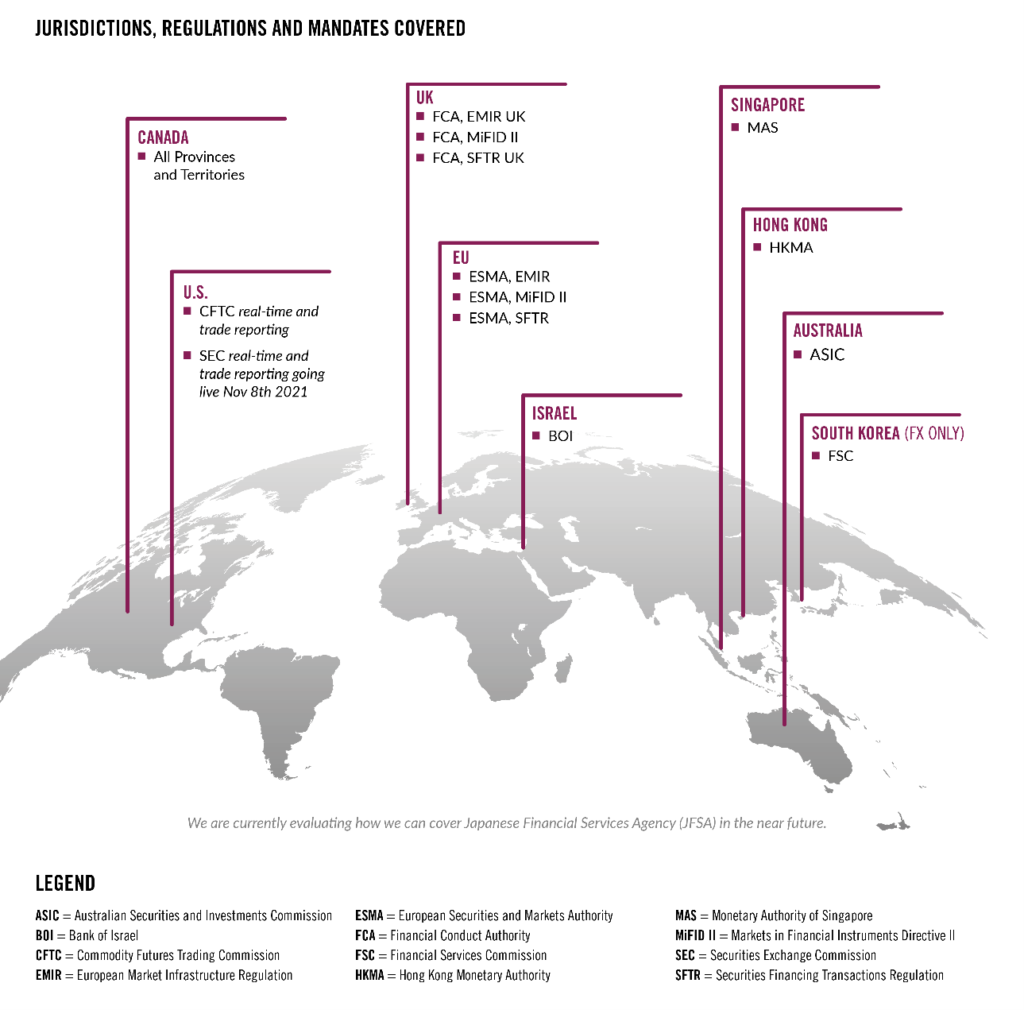

Leveraging a comprehensive pre and post trade reporting solution would help alleviate this burden. DTCC built DTCC Report Hub to perform the numerous pre and post reporting tasks that comprise a significant portion of firms’ overall trade reporting responsibilities. The platform is a highly efficient pre and post trade reporting solution that can help firms manage the complexities of meeting multiple regulatory mandates across jurisdictions. With comprehensive reporting regime coverage, the service can help firms mitigate compliance risks, enhance operational efficiencies, and drive down costs.

Prepare for the coming changes

As a comprehensive pre- and post-trade reporting service, DTCC Report Hub provides a solution for many financial institutions’ pre- and post-trade reporting needs – which is more important than ever as firms prepare to manage the coming flood of regulatory changes in the trade reporting space.

DTCC Report Hub’s robust functionality lets users choose from a wide range of features. Its pre-reporting module provides a comprehensive set of capabilities to prepare transaction data for successful submission to a trade repository (TR) or Approved Reporting Mechanism (ARM), including transformation of data from internal formats to the new ISO 20022 messaging standard. The module also includes data enrichment, automated Unique Trade Identifier (UTI) generation and exception management with a full audit trail.

DTCC Report Hub interfaces with TRs and ARMs to facilitate trade report submissions, and after transactions have been submitted, its post-reporting module let firms check for reporting accuracy and completeness and gain compliance insights through summary reports.

With large-scale changes to reporting rules on the horizon, now is an ideal time to harness the power of DTCC Report Hub to help your firm meet its reporting compliance challenges.

Subscribe to our newsletter