As they switch focus from addressing regulatory imperatives to producing superior client outcomes, buy-side firms have an opportunity to leverage internal and external data sets to deliver unique and timely investment research and analysis in support of rapid innovation and compelling new product offerings.

But faced with ongoing business challenges in the form of margin compression, limited sales resource and a lack of IT expertise, many firms struggle to free themselves from the shackles of the fragmented data architectures, legacy systems and data silos that present obstacles to creating the 360-degree customer view needed for achieving their business goals.

What’s needed is a unified approach to managing client data in order to understand customer needs and behaviours, and develop portfolio analytics and predictive models that can help the firm remain competitive, retain existing clients and attract new and different customer types.

Addressing these challenges through a consolidated approach to data based on robust data governance, the use of data standards and an emphasis on data quality, was the topic of a recent A-Team Group webinar sponsored by data technology specialist MarkLogic. The webinar featured a panel of industry experts including Louise Head, Director of Performance Analysis at Federated Hermes; Julia Bardmesser, SVP and Head of Data Architecture and Salesforce Development at Voya; and Daniel Roberts, Solutions Engineering Director at MarkLogic.

Buy-Side Business Challenges

The investment management industry has witnessed a series of consolidations over the past few years, as the impact of more stringent regulations bringing increased transparency has contributed to challenges around profitability. Beset by narrowing margins, buy-side firms have struggled to demonstrate value, particularly in the active investment space. There has been a proliferation of no-load funds in an attempt to drive sales.

The industry response to margin compression – cutting costs – has resulted in a reduction in sales resource, further hitting the ability to generate revenues and improve profitability. As a result, faced with the need to remain competitive and attract new client types, while maintaining a robust response to their regulatory responsibilities, many buy-side firms find themselves unable to react to emerging opportunities and client requests.

Data & Data Management Drivers

At the same time, in order to retain existing business and to have any hope of growth, stakeholders are requesting more and more sophisticated tools and functionality that can help differentiate the service offering and meet client demands. Investment management customers are demanding greater transparency. They want more granular and in-depth reports and more sophisticated portfolio analysis, so they can assess their managers’ and funds’ performance.

Meanwhile, many investment management firms are seeing internal stakeholders such as sales teams and portfolio managers request enhanced portfolio analytics, client behavioural analysis and predictive analytics that can give them an edge in their discussions with customers, thereby generating more business. Firms have identified the need to provide greater support through access to more data and analytics for stretched sales teams. As one webinar panellist put it: “We need to figure out how to make fewer salespeople as effective as possible.”

A Consolidated Approach to Client Data Management

Against this backdrop, many investment managers have identified the need for superior business analytics and models, both to improve client service and satisfaction and to provide better support for their sales organisations. Key to both requirements is the need for an integrated view of clients’ activities, which helps customers understand the performance and prospects of their investments, and helps sales teams understand client preferences and needs.

To gain a consolidated, 360-degree view of client data, firms need to put in place a robust data integration. But achieving this can be challenging, particularly for buy-side firms with little familiarity with the kind of major integration projects often undertaken by their larger sell-side counterparts.

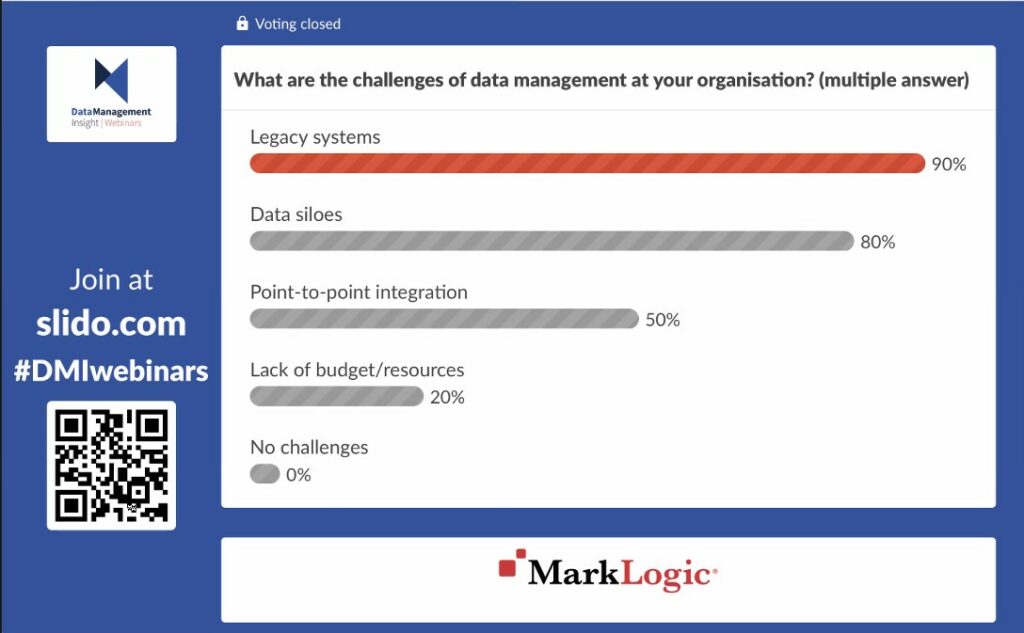

According to an audience poll conducted during the webinar, firms’ reliance on legacy platforms remains a major obstacle to progress to achieving the level of integration required to gain a clear view of the entirety of a client’s activities (see Chart, below). With many legacy platforms incapable of the performance required to deliver that view, firms are faced with the choice between expensively trying to wring more from outdated systems or put in place modern platforms capable of handling the data volumes and rates involved. At a minimum, firms need consolidated access to portfolio and position information, details of trades and trade histories, in order to derive insights into client behaviours.

Chart: What are the challenges of data management at your organisation?

Existing legacy platforms often have the added disadvantage of poor or weak data governance, which can make deriving value from them difficult and expensive. Part of the problem here is the fragmented approach to business that characterises many financial services firms, resulting in silos of data from which it can be very difficult to gain insight. Meanwhile, firms’ IT teams continue to grapple with ongoing regulatory compliance, leaving little time or resource for transformation projects. Furthermore, many firms suffer from a skillset gap, with few staff experienced in deploying new cloud or SaaS model applications.

Combined, these factors present an insurmountable hurdle for many institutions seeking to modernise their analytical capabilities. The task of transforming the underlying data architecture often proves too much for firms that lack expertise and human and budgetary resource to make the necessary changes.

Best-Practice Approaches to Leveraging Data for Improved Client Outcomes: A Checklist

Acknowledging the challenges involved, the webinar panellists identified a number of steps practitioners should consider to put in place a data integration framework that could support a modern approach to understanding client information.

How do they understand the data / analysis requirement. What data is required? What analytics do stakeholders require? And how does they drive your desired business outcomes? This applies equally to internal (sales and portfolio management) and external clients.

Use modern tools to consolidate data sets. Modern cloud-enabled tools and AI platforms using emerging technologies like machine learning and Natural Language Processing (NLP) can help integrate, cleanse and map diverse data sets to create a foundational layer for generating the desired analysis and insight.

Plan for complexity and flexibility. The data sets across multiple business silos inevitably will feature different formats, data fields and standards. Furthermore, future business or regulatory needs may generate new data requirements, and the data platform needs the flexibility to accommodate these.

Establish single unique identifiers. Allocate each client a unique identifier and use common keys to draw data pertaining to clients from multiple data sets. Implement a mechanism for pulling this data together as quickly and efficiently as possible so that any changes to an underlying source are quickly assimilated with the single client view.

Put in place a robust data governance process. To support the data analytics and data science required to produce the desired outcomes, your firm needs to have strong data governance at the heart of its culture. This means ensuring the right team has ownership of the data and has a commitment (and stewards) to look after that data. This gives consuming parties confidence that the data they are accessing comes from an authoritative source.

Design standardised client experience but reduce bespoke data provision. Leverage your data integration platform to create a standardised client experience that delivers on desired business outcomes. Investing in bespoke client reporting and other customised solutions often draws resource constraints, making it more difficult to achieve the outcomes your firm requires.

Embrace cloud to reduce cost and time to failure. Migration to the cloud can be a major project with significant challenges of its own. Avoid rebuilding your data centre in the cloud and instead use cloud-native tools to create the solution you need. This approach has the benefit of reduced cost and time to failure, emboldening your development and deployment teams.

Deploy models and analytics in the cloud. This gives access to the burgeoning population of data science tools, AI frameworks and levels of resiliency afforded by the public cloud. In short, as one panellist put it: “It’s so much easier to spin up the solutions and try things out.”

Create an internal self-service environment. Leverage your underlying data management approach to make data actionable for internal data science teams, creating a self-service environment that frees them to access the data they need without thinking about integration or ownership.

How MarkLogic Can Help

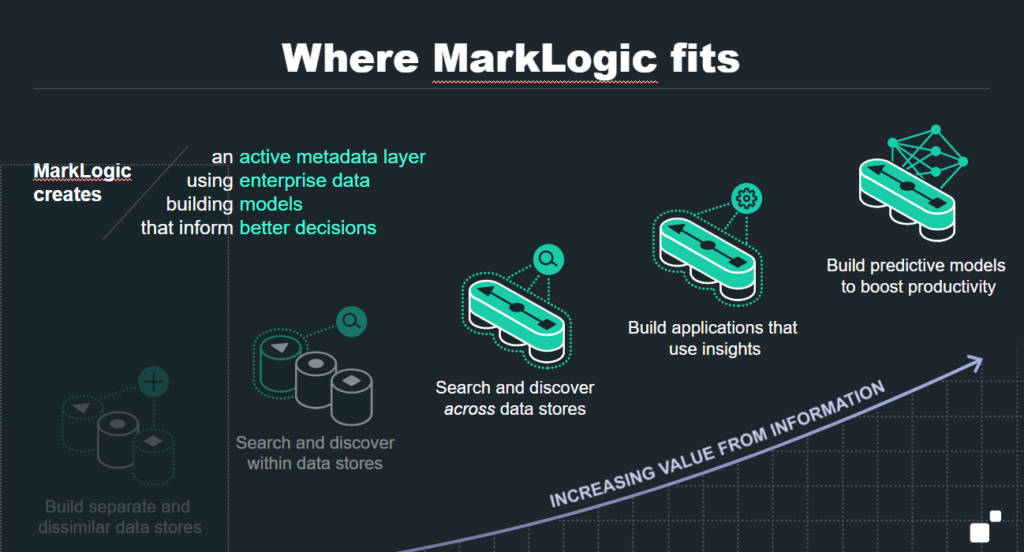

MarkLogic has leveraged machine learning and other AI techniques to develop a suite of tools and technology to help clients create a repository of enterprise data. This can be augmented with active metadata to identify and organise the data, with connections to business applications via API. This approach ensures that all applications draw upon the same single client view, in contrast to traditional ETL approaches that often draw on different incompatible data sets, making it difficult or impossible to achieve a consolidated view.

With this platform in place, MarkLogic provides tools to implement governance rules and policies that ensure data sets are well governed, with the same nomenclature, formats and standards in place across the entire organisation. This foundation can then be used to drive data science models, machine learning, predictive analysis and other analytics that can help the firm reach its desired outcomes.

Subscribe to our newsletter